In this guide, will walk you through the key things to consider before you buy a dental practice. We’ll cover how to evaluate potential practices, secure funding, and handle the challenges of ownership. With the right approach, you can make a smart decision that sets you up for long-term success.

Key Takeaways

- Are You Ready? Make sure you have the skills, experience, and financial stability needed to run a practice.

- Pick the Right Practice. Location, patient base, and the type of practice all play a big role in your success.

- Know the Numbers. Look closely at revenue, expenses, and funding options before making a decision.

- Sort the Legal Side. Carefully check contracts, regulations, and all necessary paperwork.

- Negotiate Wisely. Structure the deal well to get the best possible terms.

- Plan for a Smooth Transition. Keeping staff and patients happy will help your practice thrive in the long run.

Make Sure You Are Ready to Buy a Dental Practice

Buying a dental practice isn’t just about money, it’s a full-time responsibility. You’ll be managing staff, finances, legal matters, and patient care, all while keeping clinical standards high. Before you jump in, take a step back and assess if you’re truly ready to be a practice owner.

Click here to read more about whether you should start or buy a dental practice.

Clinical and Management Experience

Most sellers and lenders prefer buyers with at least 3-5 years of experience after qualification. This ensures you’ve developed the clinical and operational skills needed to run a practice smoothly.

It’s not just about years in the field. Have you managed a team, led patient care, or handled day-to-day practice operations? Experience in treatment planning, staff coordination, and patient management shows you’re ready to take the next step.

A Strong CV

Your CV isn’t just for job applications, it plays a key role in securing financing. Lenders will review it to assess your credibility. Make sure it highlights:

- Clinical expertise: The procedures you handle, patient volume, and any specialisations.

- Leadership experience: Managing teams, mentoring juniors, or taking on senior associate roles.

- Business exposure: Involvement in practice operations like finances, audits, compliance, and stock management.

A well-structured CV reassures lenders and sellers that you have what it takes to succeed.

Your Financial Health

Before you start looking for a practice, check your finances. Here’s what lenders will assess:

- Deposit: You’ll need 10-20% of the practice value upfront. A higher deposit improves your financing options.

- Personal finances: Minimal debt and a good savings record show financial stability.

- Credit history: A clean credit score is crucial. Sort out any issues before applying for loans.

Lenders will closely examine both your personal and professional finances, so keep your records in order.

A Solid Business Plan

A well-prepared business plan gives you an edge over other borrowers and buyers. While it will be customised for your chosen practice, having a draft ready shows credibility. Include:

- Your vision: Growth plans, patient care approach, and branding.

- Market research: Local competition, patient demographics, and demand.

- Financial projections: Expected income, expenses, and profit margins.

- Operational strategy: Staffing, equipment upgrades, and marketing.

A clear business plan strengthens your case with lenders and helps you stay focused.

You can learn more about how to build a business plan for a dental practice here.

The Right Mindset & Time Commitment

Owning a practice isn’t a 9-to-5 job. You’ll juggle multiple roles, from clinical care to HR, marketing, and financial management. Ask yourself:

- Do I have the time and energy for both clinical and business responsibilities?

- Am I ready to manage staff, handle conflicts, and lead a team?

- Can I invest time in marketing and patient retention?

- Do I have the right support system (mentors, advisors, financial backing)?

If you answered yes, you’re on the right track! Buying a dental practice is a major step, but with the right preparation, you can make it a smooth and successful journey.

Click here to read more about why dentists want their own practices.

How Long Does it Take to Buy a Dental Practice?

The short answer to this question is: it takes as long as the buyer and seller allow it to take.

Like any important transaction, buying a dental practice hinges on whether or not the buyer and seller can agree upon a price and contract terms. As the buyer, you are expected to make the initial offer on the practice, with negotiations to follow.

However, there are many tasks that you, or a representative like Samera Business Advisors, must perform in order to make sure that your transaction is legal and your resources are secure. These include:

- Care Quality Commission (CQC): The timing and execution of your CQC application is crucial to ensure that you are ready to begin operation of your practice after ownership is transferred; without CQC approval you won’t be able to trade.

- Funding: Unless you plan on financing your transaction in cash, you will likely be using your bank for funding. Banks are notoriously cautious. Both parties will need to agree the terms of borrowing with a business manager, and the contract will need to be approved by the bank’s Securities Department. Using a finance broker will help you ensure you consider all the funding options available in the market.

Click here to watch our free webinar and find out more about financing your first dental practice - Property and Leases: Often, the property side of the transaction can slow the deal down. It’s important you have a property lawyer that can assist in ensuring any lease in place can be assigned to you as new owner.

Click here to find out more about leasehold vs. freehold.

How Much Will You Have to Pay?

A deposit of at least 10-20% is standard when buying a dental practice, whilst the remainder can be financed from a bank. The minimum cash deposit will usually be 5%.

It’s important to remember that when the lenders use their estimate of 80% of the value, they’re only estimating that value on goodwill. They do not include the fixtures and fittings in that. This is especially important to remember if the fixtures and fittings figure it quite high.

Click here to learn more about the fees and costs of buying a dental practice.

When a lender assesses your loan application they will be looking at a variety of factors. These include:

- Your earning history as an Associate Dentist

- Your financial track record and how you have managed your personal finances e.g. do you have high credit card balances is always a bad time to apply for a loan.

- Your current living situation i.e. do you own your own house or rent?

- Your management experience and number of years you have from leaving Dental School

- Your ability to repay the loan with a comfortable margin of error if interest rates rise

- If you place an offer for a practice and do not have available funds (or a finance agreement in place) you risk being unable to buy a practice whilst losing credibility with a seller.

Finding the Right Practice to Buy

Before scrolling through listings or calling brokers, take a step back. The right practice is more than just good numbers, it should fit your skills, goals, and long-term life plans. Here’s what to consider before making a decision.

Types of Dental Practices

Understanding different practice models will help you choose the best fit for your career, skills, and risk appetite.

- NHS Practices: These rely on NHS contracts, with payments based on Units of Dental Activity (UDAs). They offer a steady income but come with strict compliance rules and less flexibility in pricing. Owners must manage UDAs efficiently to maintain profitability.

- Private Practices: These operate independently, setting their own prices and offering a wider range of treatments. They have greater earning potential but depend on strong patient relationships, good marketing, and consistent service quality. Revenue can fluctuate with demand and economic conditions.

- Mixed Practices: A blend of NHS and private services, these practices balance stability and flexibility. Managing the right mix is key to maintaining profitability while meeting NHS contract requirements.

- Squat Practices: Starting from scratch is risky but rewarding. This requires heavy investment in premises, equipment, and patient acquisition. It’s best suited for those with strong financial backing and a clear business plan.

- Dental Group: A dental group is 2 or more dental practices that all work together under a single name or brand. Dental Groups allow you to cover more locations, offer specialised services and grow your profits/assets. You can learn more about how to build a dental group here.

Understanding the Market

The UK dental market is competitive, especially in busy urban areas. Several factors influence a practice’s value and desirability.

- Location: Prime locations like London and the South East have high demand but also higher prices. Rural or suburban areas may be more affordable but may also require extra effort in attracting patients.

- Profitability and Goodwill: A practice’s value is based on its profit (EBITDA) and goodwill. Goodwill includes brand reputation, patient loyalty, and overall business strength.

- Speed of Sale: High-demand practices sell fast. Buyers should be financially prepared to act quickly when a good opportunity arises.

Key Factors That Affect Value

When assessing a practice, focus on these important measures:

- EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortisation): This shows how profitable a practice is and is a key factor for lenders.

- Goodwill Percentage: This reflects the reputation and patient base. It often makes up a large part of the purchase price.

- UDA Rate (For NHS Practices): A lower UDA rate means more work is needed to generate the same income.

- Patient Base: A stable, loyal, and high-spending patient base is a sign of a strong practice.

- Premises and Equipment: Check whether the property is leasehold or freehold and whether the equipment is up-to-date or upgrades are needed.

Read our article on dental practice valuations to find out more.

Sorting Out the Finances

Before moving forward, make sure you understand the financial side of things.

- Deposit Requirements: Most lenders expect a 10-20% deposit, but strong applicants may get better terms.

- Loan Affordability: Lenders will assess whether the practice can generate enough income to cover repayments.

- Pre-approval: Getting an Agreement in Principle (AIP) from a specialist lender gives you an advantage when negotiating.

- Additional Costs: Legal fees, valuations, regulatory applications, and working capital should be factored in.

Finding the Right Fit

Beyond the financials, the practice should match your personal and professional goals. Ask yourself:

- Does it suit my clinical expertise (cosmetic dentistry, orthodontics, implants, etc.)?

- Does the location and workload fit my lifestyle?

- Does it align with my plans for expansion and future services?

Taking the time to assess these factors will help you find a practice that’s both profitable and personally rewarding.

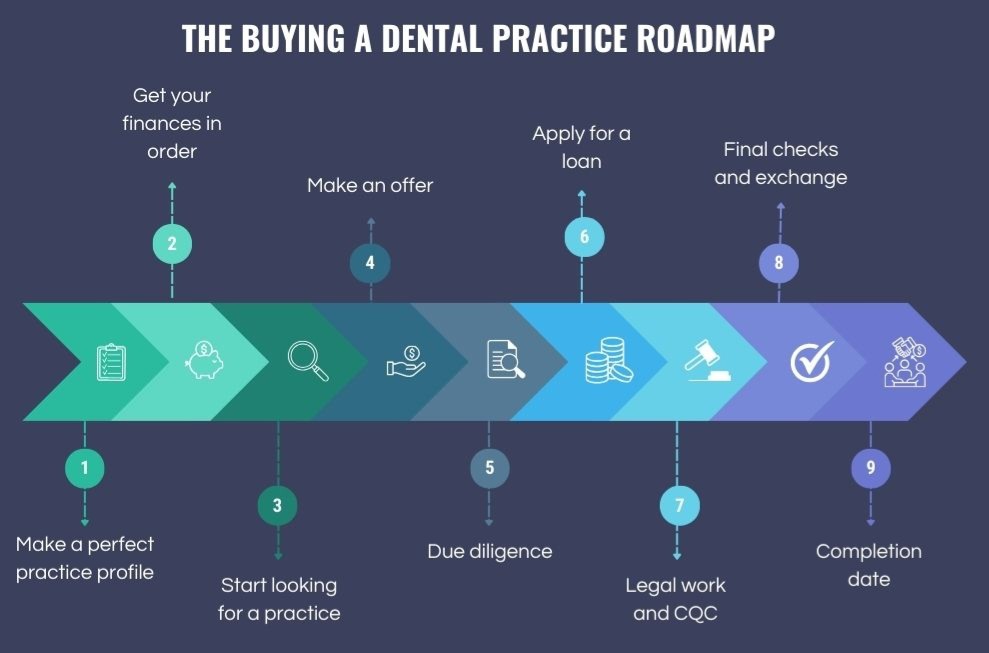

How to Buy a Dental Practice: Step by Step

Once you’ve done your homework and feel confident, it’s time to jump into the process. Here’s a clear and straightforward roadmap, from your first search to taking over the practice.

Step 1: Know What You’re Looking For

Before you start searching, take some time to figure out exactly what you want. Make a profile of the perfect practice that you’re looking for.

- Location: Think about how far you’re willing to travel, what kind of patients live nearby, and how much competition is in the area.

- Type of Practice: Do you want an NHS, private, mixed, or brand-new (squat) practice?

- Size and Setup: How many surgeries? How big is the team? Can it handle the number of patients you want?

- Room to Grow: Is there space to offer more services or run things more efficiently?

The clearer you are about your goals, the easier it’ll be to shortlist the right practices and negotiate with confidence.

Think hard about the location, type and size of practice you are buying – NHS/Mixed or Private? For your first practice, don’t underestimate if you have to travel quite far the impact this can have on your life. Some better deals maybe available away from the main cities, but this often means you having to compromise on lifestyle – it has to be a very personal decision.

Arun Mehra

Samera CEO

Step 2: Sort Out Your Finances

Before you speak to any sellers, get your finances in order.

- Talk to a dental finance broker or specialist lender to find out how much you can borrow.

- Try to get a pre-approval or an Agreement in Principle, it shows sellers you’re serious.

- Pull together a simple financial summary, include your savings, any assets, and your credit history.

- Draft a basic business plan, it doesn’t have to be perfect, but a clear structure helps.

Being financially prepared makes things smoother and puts you in a stronger position with lenders and sellers.

Read our article on how to finance a dental practice to learn more.

Early in the process understand how much you can borrow with the deposit you have in place. If you don’t have a deposit, start saving early. Get in touch with the Samera Finance team, they should be approached early on as they will be able to help you understand the maximum you can borrow and hence the size of practice you can purchases.

Arun Mehra

Samera CEO

Step 3: Start Your Search

Once your finances are sorted, it’s time to look for your future practice.

- Use dental brokers, they list and sell practices regularly.

- Ask around, suppliers, labs, accountants, and other dentists might know of hidden opportunities.

- Sign NDAs, this gives you access to detailed info, but keeps things confidential.

- Visit practices with a checklist, look at the premises, equipment, staff contracts, patient base, and revenue streams.

Don’t rush. Take your time and do your research, this is a big decision.

Register with all the agents on the market and as I mentioned before be quite ruthless about what you want to buy. Don’t be pressured by any of the agents, as remember they are being paid by the vendor to get the best sale price.

Go and see as many practices as possible – the more you see the better the idea you will get as to what you like but more importantly don’t like.

Arun Mehra

Samera CEO

Step 4: Make an Offer

Found a practice you like? Time to make your move.

- Put forward a fair offer, based on the valuation, goodwill, and assets.

- Include a deposit, usually 10-20% of the total price.

- Mention any conditions, like asking the seller to stay for a handover, or needing CQC approval before completion.

If the seller agrees, both sides sign what’s called ‘Heads of Terms’ – a document that outlines the deal before the official contracts are drawn up. Lawyers will need to be engaged and heads of term drafted which outline the deal value and structure. Once these are agreed the proper due diligence begins.

If you like the look of a practice, ask the agent for up to date accounts and information. If up to date information is not available, ask the question why not? If the vendor is serious they could at least spend a few thousand pounds to provide some transparency to you.

Once you have the required information, it’s imperative to analyse this and assess what the practice is worth to you. Do your own sums, or work with a firm like ours, who has done this so many times. This is the opportunity to offer a price that works for you.

Of course there may be some negotiation but eventually a price maybe settled on, however, this is still near the beginning of the buying process and a lot can still change!

Arun Mehra

Samera CEO

Step 5: Check Everything (Due Diligence)

Before you fully commit, you’ll need to dig into the details and make sure everything is above board.

- Financials: Go through accounts, tax returns, income, and expenses.

- Legal Side: Look at staff contracts, NHS agreements (if any), lease details, and compliance paperwork.

- Day-to-Day Operations: Review equipment, software, staff setup, patient numbers, and marketing efforts.

Get professional help from dental accountants and solicitors, this step is crucial and can save you from nasty surprises.

Lawyers will need to be engaged and heads of term drafted which outline the deal value and structure. Once these are agreed the proper due diligence begins.

Whilst legal and clinical due diligence occurs, one of the most important aspects that needs to be carried out is financial due diligence. Do the numbers presented actually represent reality? This is so important as things may be found that can provide you the opportunity to re-negotiate the price. Unfortunately I have seen some dentists ignore this step at their peril, only realising after they have taken ownership that they have been ripped off!

Arun Mehra

Samera CEO

Step 6: Apply for Your Loan

Once you’re happy with the practice and everything checks out:

- Submit your business plan and financial documents to your lender.

- Be ready to provide cash flow forecasts, profit projections, and a repayment plan.

- If all goes well, the lender will send you a formal loan offer with all the terms.

Step 7: Legal Work and CQC Application

Now things get more official.

- Your solicitor will draft the sale agreement and make sure the terms are legally sound.

- If the property is leased, the lease needs to be checked and transferred.

- If there’s an NHS contract, make sure the transfer process is followed properly.

- Apply to the Care Quality Commission (CQC) this can take 10-12 weeks, so start early.

Make sure to reply quickly to any document requests to avoid delays.

Step 8: Final Checks and Exchange

Before signing the contracts, double-check everything:

- Your loan is approved and the money is ready.

- CQC registration is on track.

- Any legal questions have been resolved.

Once it’s all good, both parties sign the contracts, and a completion date is set.

Step 9: Completion Day

This is the big day.

- The money is transferred, and the practice officially becomes yours.

- Let staff, patients, suppliers, and regulators know about the change.

- Make sure everything’s ready, payroll, insurance, software access, banking, all should be in place for a smooth handover.

Once all the legal aspects have been covered, then the legal exchange and completion occur, and then you have the excitement of being the new owner of your dental practice!

Arun Mehra

Samera CEO

Step 10: Settle In

The first few months are all about building trust and settling in.

- Agree a handover period with the seller, usually 3-6 months helps things run smoothly.

- Keep key staff and reassure patients, don’t make big changes too quickly.

- Start rolling out your business plan, take it slow, and focus on what will make the biggest difference.

A calm and steady start will help your practice thrive in the long run.

Our Tips When Taking Over a Practice

Check the Ratios and Find the Potential Profit

It’s important to chart the potential profit of your new dental practice. How much of an opportunity for growth do you see?

Make sure you ask how many active (seen in the last 10 months) patients the practice has. Out of those active patients, what are the ratios between check-ups versus treatments? That will give you a birds-eye-view of the type of work and, therefore, cash flow you are inheriting.

Ask the seller for a short (3-5 examples) list of their most outstanding treatments to gauge the effectiveness of their follow up system. If the seller is a member of a local business referral group or association, follow up with other members. After all, you are entering their community and early networking prevents many headaches.

Key Performance Indicators (KPIs) like these reveal the day-to-day work being done to maximize the practice’s earning potential. There are a number of dental KPIs, but let’s look at a few basic numbers you must ask for:

- How many new patients have they generated in the last 12 months? Is this rate on the rise?

- What are the exam and hygiene recall rates? Are they rising?

- What marketing is working the best for the practice and which marketing avenues are exhausted?

- What’s the level of new patients received from direct referrals?

- What is the patient retention rate? How many patients did the practice lose over the last 12 months?

This will help you to understand how good the patient experience is and what you can do to improve it.

Keep the Dental Team

We think it is important to retain the team when you buy a new practice. Think of them as one of the assets of the business. They already have the trust of and their own loyalty to your patients, they are more loyal to each other and the practice (in most cases) and they have the knowledge of the business.

If you buy a dental practice and start getting rid of staff, you’re also getting rid of knowledge and experience. Not just in dentistry in general, but in your practice and client base in particular.

If you want to build that loyalty and trust between yourself and your team as the new owner, consider holding one-to-one meetings, or group meetings with different teams, like your nursing or orthodontic teams.

Also, look at their pay. Make sure they are at least in line with national averages and include performances bonuses – there aren’t many better ways to get a team onside!

Enroll the whole team in your vision for the practice, it’ll make it easier to realise.

Click here to read more about building a dental team.

Digital Marketing

Hopefully, the practice you buy will already have a marketing strategy that works well. However, if you’re buying a struggling practice or you just want to start growing straight away you’re going to need your own strategy.

Find out what the practice currently does to bring in new patients. Are they using Pay-Per-Click ads? Do they rely on footfall or word-of-mouth? How well does the website rank on Google? What offers or referral schemes do they have?

Talk to your new team to find out what works, what doesn’t work and what hasn’t been tried yet. Also talk to your patients – especially new patients and your most loyal returning patients. Find out how they found you and what kept them coming back.

Click here to read our article on How To Market A Dental Practice

Manage the Transition Period

To use a cliche – when you buy a dental practice you’re joining an existing ‘family’. The team (which we think you should keep intact as much as possible) and the patients are all used to a certain way of things.

Unless the practice is struggling intensely, don’t change too much too quickly.

Of course, you’ll need to put your own stamp on things. You have your own mission and vision and it is important you start to implement it. After all, that’s why you bought the practice!

But while this happens, it’s important to maintain open and honest communication with the staff. Hold regular meetings early on – don’t be a stranger.

Use these meetings to understand the current processes both in the clinic and in front-of-house. The staff will know better than you do what works and what needs improving. Take their advice, welcome their suggestions and work together with them to improve what you can.

Common Pitfalls to Avoid

Even if you’ve done your homework, it’s easy to trip up along the way. Arun warns, “It’s a long process, and requires tenacity, and paying for professionals who know what they are doing. Don’t cut corners on probably one of the biggest investments you make in your life, as this may come home to roost if you do!”

Click here to listen to our podcast episode on the 7 legal pitfalls of buying a dental practice.

Here are some of the most common slip-ups buyers make and how you can avoid them.

Paying Too Much for Goodwill

It’s easy to get attached to a practice, especially if it feels like “the one.” But don’t let your emotions lead you to overpay.

Here’s how to keep things in check:

- Base your offer on the practice’s actual earnings (known as EBITDA), not what you think it might earn in the future.

- Get an independent valuation from someone who knows the dental market.

- Don’t assume all patients will stay just because the practice has a good name.

Paying over the odds can put pressure on your finances for years. So, take your time and make sure the numbers add up.

Skipping Proper Checks (Due Diligence)

Rushing this step can leave you with nasty surprises after you’ve taken over.

Protect yourself by digging into the details:

- Look closely at staff contracts, are there long notice periods, disputes, or hidden costs?

- Check equipment leases, some might be outdated or come with pricey terms.

- Ask about NHS clawbacks, these can take a big chunk out of your cash flow.

- Review any past problems with the CQC or GDC, old issues can quickly become your problem.

Work with professionals who understand the dental world they’ll know what to watch out for.

Ignoring the Team

You might be buying a business, but it’s the people who keep it running smoothly. A happy, stable team can make all the difference.

So, make sure to:

- Look at staff morale and turnover, a high turnover could mean deeper issues.

- If possible, have a chat with a few key team members to hear their thoughts.

- Think about a staff retention plan, experienced team members often hold valuable relationships with patients.

If the team’s not on board, your first few months as an owner could be a bumpy ride.

Not Planning for Day-to-Day Costs

Buying the practice is just the start, you’ll also need enough working capital to keep things ticking over.

Make sure you’ve got money set aside for:

- Staff wages: Especially if there’s a delay with NHS payments.

- Gaps in private income: Patients might pay in stages.

- Quick fixes: Older equipment or tired premises might need attention.

- Marketing: If patient numbers drop, you’ll need to get the word out.

Having a cushion of around 3-6 months’ running costs can make all the difference.

Messing Up the CQC Process

CQC registration often causes delays, and the process isn’t always straightforward.

Here’s what to watch for:

- Don’t send in an incomplete application, it’ll just get sent back.

- Give yourself plenty of time, approval usually takes 10 to 12 weeks.

- Show you’ve got a solid plan for meeting CQC standards.

If it’s all a bit much, bring in a CQC specialist to help you get it right the first time.

Click here to find out more about building a CQC compliant practice.

Not Having a Post-Sale Plan

Lots of buyers focus so much on getting the deal done that they forget about what happens after. Don’t leave it to chance.

Make sure you:

- Have a clear plan for the first few weeks – team meetings, patient updates, supplier contacts, etc.

- Get immediate access to everything – software, payroll, banking, insurance… all of it.

- Know how you’ll introduce yourself to the team and patients on Day 1 – first impressions matter!

A well-thought-out plan keeps things running smoothly and builds trust from the get-go.

Click here to find out more about patient retention.

Buying a dental practice is a big step and yes, it comes with a learning curve. But by staying alert to these common mistakes and planning ahead, you can set yourself up for a smooth and successful start.

Who You’ll Need on Your Side

Trying to buy a dental practice on your own can lead to expensive mistakes. That’s why it’s so important to have the right people by your side especially professionals who understand the dental world inside out. These experts can help make sure the whole process goes smoothly, legally, and doesn’t drain your wallet.

Here’s who you need on your team:

Dental Solicitor

Not just any solicitor will do. You need someone who’s handled dental practice sales before and knows what to look out for.

Here’s what they’ll take care of:

- Sale and Purchase Agreement: They’ll write and check the contract to make sure both sides agree on everything, including the price and any special terms.

- CQC Process: Your solicitor will help with the Care Quality Commission (CQC) paperwork, so you meet all the legal requirements.

- Lease or Property Transfer: If there’s a property involved, they’ll handle the legal side of transferring or updating the lease.

- NHS Contract Transfers: If the practice has an NHS contract, they’ll make sure it’s properly moved into your name.

- Staff Transfers (TUPE): They’ll help you follow the legal rules for taking on existing staff, so you stay on the right side of employment law.

Their main job is to protect you legally and flag any risks before you commit.

Dental Accountant

A good dental accountant won’t just do the maths they’ll help you understand whether the practice is financially sound and what it’s really worth.

They’ll help with:

- EBITDA Analysis: Looking at the practice’s earnings to check how profitable and stable it is.

- Tax Advice: Making sure the deal is set up in the most tax-friendly way.

- Deal Structure: Whether to buy as a sole trader, a limited company, or something else, they’ll guide you based on your situation.

- Financial Due Diligence: They’ll dig into the numbers to check for any red flags.

Ideally, your accountant will stick with you after the deal, helping with things like payroll, forecasting, and tax returns.

Commercial Finance Broker

Getting a loan to buy a dental practice isn’t always straightforward. A finance broker who knows the dental sector will already have contacts with lenders who understand the business.

They can:

- Help With Your Application: Making sure everything is presented clearly and professionally to increase your chances of approval.

- Negotiate with Lenders: They’ll talk to the banks for you, aiming to get the best deal possible.

- Boost Your Approval Odds: They know how to position your application to make lenders more likely to say yes.

Most of the time, brokers are paid by the lender, so you usually don’t have to pay them directly. A good broker can save you a lot of time and stress.

CQC or Regulatory Consultant (Optional)

Your solicitor might handle the CQC process, but if they don’t, it’s worth hiring a CQC consultant. These specialists know exactly how to get your registration sorted without the hassle.

They’ll:

- Prepare and File the Paperwork: Making sure your applications are correct and submitted on time.

- Advise you: A CQC specialist will be able to help make sure you pass your inspection first time round.

- Save You Time: If you’re already juggling work and life, having someone else manage this process can be a huge relief.

While it’s an extra cost, it’s often worth it just for peace of mind especially if you’ve never dealt with the CQC before.

Valuation Expert

If you’re buying straight from the seller, without a broker involved, you must get an independent valuation. It’s the only way to know if the asking price is fair.

They’ll:

- Work Out What the Practice Is Really Worth: Based on finances, assets, and what’s happening in the local market.

- Stop You Overpaying: You’ll have the numbers to back up your offer (or walk away if needed).

- Strengthen Your Negotiating Power: A proper valuation gives you solid ground to stand on during price talks.

When there’s no broker, a valuation expert can be your best defence against overpaying.

Surrounding yourself with the right experts, solicitor, accountant, broker, and maybe a CQC or valuation pro will help you avoid pitfalls and make smarter decisions. Yes, it’s an investment, but it could save you thousands in the long run (not to mention the headaches!).

Buying a dental practice isn’t just a business deal, it’s the start of your journey as a practice owner. With the right planning, expert advice, and a clear vision, you can avoid common mistakes and make smart choices. Take your time, do your homework, and build a team you trust. When done right, this can be a rewarding and profitable step towards a bright future in dentistry.

Our Opinion

“Over the last 20 years I have personally been involved with several hundred dental practice purchases. From first time buyers to large corporate groups, I have seen most things across the accountancy and financial spectrum.

Many inexperienced buyers, feel they have to offer the price the vendor wants for the practice, whilst sometimes the price may be justified, often it isn’t, so when you start your journey of buying a dental practice, it is imperative to get some help in the process.

It’s a long process, and requires tenacity, and of course paying for professionals who know what they are doing.

Don’t cut corners on probably one of the biggest investments you make in your life, as this may come home to roost if you do!

Good luck and get in touch with the Samera team who can help”

Buying a Dental Practice FAQs

Why Should You Use A Dental Practice Broker And Dental Sales Expert Such As Samera When Buying A Practice?

We have a personable and sustainable relationship with our registered buyers, and we always strive to match the right practice with the right buyer. We listen to each buyer and discuss their selection criteria, sourcing the right practice.

What is EBITDA?

EBITDA is (E)arnings (B)efore (I)nterest, (T)axes, (D)epreciation and (A)mortisation it is an industry-standard way of determining a business’s profit and overall financial performance.

It is one of the key metrics we use to valuate dental practices.

What Is Due Diligence?

Due diligence is a very important exercise carried out during any dental practice sales and acquisitions process.

It is divided into legal and financial due diligence. It is an exercise to confirm that all information provided at the time of discussing and agreeing to offers is accurate and precise.

Information such as accounts, management accounts, patients number, staff contracts, NHS contracts and any legal issues such as change of control clauses, lease and property contracts, are just some of the documents to be checked and diligently controlled.

An expert legal and financial team will know what to look for in a professional and time-effective way.

Why Should I Carry Out The Due Diligence Exercise?

After you visit the practice and check the property and surrounding areas, have a good look at the last 3 years’ financial statements. Find out if the turnover is steadily increasing or decreasing and check if the private revenue is made up of fee-per-item or capitation scheme.

You also want to check if the number of full-time equivalent dentists is less than the number of surgeries, so that there is an opportunity to increase the workload and the revenue.

If the practice is incorporated, make sure that there is not a ‘change of control clause’ in the NHS contract and, if you are buying halfway through the year, check the performance of the UDAs delivery to avoid any unwanted clawback in the next financial year.

Do I Need A Specialist Dental Lawyer?

Never consider the services of a solicitor or a firm with no experience with dental practice sales.

It’s that simple. But occasionally we experience some dental principals going down the route of a solicitor who may be brilliant dealing with purchasing houses, but could slow down the process of selling or buying a practice, potentially increasing your legal fees or asking unnecessary or more than necessary due diligence documentation to complete, ending up wasting precious time.

You can find out more about the legalities of buying and selling a dental practice here.

How Do You Value A Dental Practice?

Every practice is unique and every single dental practice has a price range of value, dictated by many factors and many variables.

It is important to look at the last 3 years’ set of accounts as well as the latest and up-to-date management account to see any upward or downward income trend. The surgery percentage of utilisation and opportunity to expand are also factors that can potentially increase value and marketability.

You can find out more about dental practice valuations here.

How Long Does The Dental Practice Sales Process Take?

The average timescale for a dental practice sales deal to complete is approximately 5 or 6 months.

However, there are many factors, such as the type of practice and the legal and financial support team selected, that can influence the timeframe and speed up or slow down the process of buying a practice.

What If I Buy A Practice With NHS Contract?

If you’re buying a dental practice with an NHS contract, ask for the electronic copy of the GDS or PDS contract, checking all variations and any potential change of control clauses.

Regarding the sale of the dental practice with the NHS contracts, there will be 28 days’ notice between exchange and completion to add to the NHS element of the deal.

What Is The Dental Practice Sales Process?

We like to simplify the process of buying and selling a dental practice to 8 major steps.

Initial enquiry – the vendor sends the completed data collection form to Samera and initial discussion with our team takes place.

Valuation and practice visit – this is when we confirm the key variables and arrange a visit at the practice and our report is discussed with the vendor(s). Phase one of Samera marketing process is explained and begins straight after the meeting.

Viewings – Phase 2 of Samera marketing process. This consists of arranging appointments with potential buyers that have already been screened and viewing the property.

Offer stage – we negotiate the best financial package and best terms, then Heads of Terms are negotiated and agreed.

Due diligence – key information and documents are reviewed by legal teams.

Ongoing Support – we are there at every step of the way, supporting sellers during the financial and legal due diligence for a smooth completion.

Completion – sales and transfer of funds to the vendor’s bank account.

Does The Practice Need To Have A Partnership Structure?

No, not necessary. A buyer will always consider private limited companies and sole traders. Each one is treated differently from a legal perspective and the way in which NHS England is informed is different depending on whether the vendor decides to sell the dental practice via assets sale or shares sales.

What Issues Do You Come Across When Dealing With Dental Practice Sales?

We have never encountered an issue that we can’t resolve.

No practice is the same, but we have never encountered an issue that we can’t resolve; sometimes it just takes a little longer. Any problems usually come to light at the due diligence stage when all documents are thoroughly inspected.

The most frequent time delaying issues are regarding the property or the lease negotiations.

What Type Of Deal Structures Are Available On The Market?

We are experts in the buying and selling of dental practices and we will help all dentists to structure a deal to suit them.

Each dentist has specific expectations, tax situations and desires.

Payments usually take the form of upfront transfer on completion for NHS-driven profits, deferred payments for performance-based criteria, earn-out for private revenue, and negotiated UDA rates for vendors working at the practice after completion, who may prefer to have a higher on-going salary rather than an upfront payment depending on their individual tax position.

Why Do Dentists Sell Their Dental Practices?

Investing in alternative businesses and retirement. The most common reasons for selling a dental practice are investing in alternative businesses, to add to a retirement fund or to gain freedom from all of the administration and regulations of running a practice, allowing the vendor to once again focus on the things they enjoy.

How Much Money Is Needed For Buying A Dental Practice?

You should always discuss your financial position with an expert broker and usually have at least a 10% deposit when thinking of buying a practice.

Most lenders will offer a maximum of £500,000 unsecured loan per dentist, depending on the practice and personal situation so if you are thinking of buying a practice worth £1,500,000 with a partner, you must have a minimum of £500,000 deposit.

If you place an offer and don’t have available funds or a finance agreement already in place, you risk being unable to buy a practice and, of course, losing credibility in the dental world, where news travels at the speed of light.

Who Is Selling And Their Reasons For Selling?

More often than not we come across sellers wishing to take the practice to the next level with a new buyer, whilst relinquishing the responsibility of running the practice, as they have done this for many years.

Having a seller deciding to stay at the practice to help with the transaction time is most valuable for any buyer, especially a young dentist buying a practice for a long-term project.

So, have a good conversation with the seller and explain your idea, as money is not the only driver for a seller.

Why Should I Check The CQC Inspection Report?

Once your offer is accepted and you are in the process of the due diligence, check the quality of the equipment, cabinetry, compressors, floor or anything that could perhaps cost you money from day one.

You also need to ask the details and date of the last CQC inspection and DDA compliance to make sure that any potential requests outlined in the report have been satisfactorily covered. Your solicitor will help you with checking all equipment certificates, as well as indemnity insurance for the staff.

What If The Seller Is Becoming An Associate?

The seller may wish to stay at the practice for a number of years. Make sure you discuss and agree on an associate contract with the seller and agree on the number of UDAs to be performed, pay per UDA and working hours.

Of course, if the seller is not staying at the practice, make sure that there are some restrictive covenants preventing the seller to work near the practice that you have just bought.

A minimum of 2.5 miles in a rural area and 0.5 miles in a city should apply.

What If I Wish To Buy The Property?

For a vendor, the options are either selling the property or have a lease in place with the buyer.

The property will be valued as a commercial property and not on a residential basis so this is a point to consider when thinking about buying it or not.

What If There Is A Lease On The Property?

If there is a lease on the property and the lease is less than 15 years to the expiry date, it is advisable to talk to the landlord about a potential extension and engage the landlord at an early stage.

Any buyer would want at least 15 years lease or more if possible and the likelihood is that the landlord would ask for his legal costs to be covered.

Do I Need To Have All My Certificates Ready And Available?

During the due diligence process, you will be asked to provide and show your certificates such as the GDC registration.

Have all those ready and will save you time and during the selling process.

Do I Need To Ask For An Inventory?

Yes most certainly so, it takes some time and is boring but it will create clarity with regards to the items purchased at the practice and the items that are taking away. Also it will avoid any potential arguments and dispute further down the dental practice sales process.

Will The Dental Practice Sales Process Trigger A New CQC Inspection?

Care Quality Commission is another potential reason for a delay in buying a dental practice. Sometimes even 3 months delays if either the buyer or the seller don’t have their DBS check ready and available to submit, or the practice has not been inspected lately.

The process of selling the dental practice will involve deregistration of the seller and registration of the buyer to work at the practice. This process will likely trigger a new CQC inspection, unless one was carried out recently. So, have everything ready and DBS not older than 6 months.

What Happens To The Equipment Still Leased?

If all, or part, of your equipment is leased, sellers could either transfer the arrangements to the buyer or pay it off, which is usually most buyers’ preferred choice.

What Are The Legal Warranties?

Most solicitors acting on behalf of their clients as buyers will advise their client to include in the Standard Purchase Agreement ( SPA ) document, a warrant from you as a seller that all information provided including any financial and contractual aspect of the practice is true and accurate.

On the other hand, the seller’s solicitors should negotiate and deal with the warranties in a way that protects the vendor and minimise their risks against potential claims in the future.

You can find out more about legal issues when buying a dental practice here.

What is a deferred payment structure?

When buying or selling a dental practice, a deferred payment deal is one where part of the agreed-upon price of the practice is withheld and paid over a series of months or years.

These deferred payments are often tied to the performance of the practice. In other words, if the practice underperforms in certain key areas, some of the deferred payment is reduced.

Learn more: Related Articles

Glossary: Key Terms to Know

- Goodwill: The intangible value of a dental practice like patient loyalty, brand reputation, and relationships. It’s not physical equipment but still adds to the price.

- EBITDA: Short for Earnings Before Interest, Taxes, Depreciation, and Amortisation. It’s a way to measure how profitable a business is before the complicated stuff like tax and loans are added in.

- Due Diligence: A deep check of the business before buying to make sure there are no hidden problems or financial surprises.

- NHS Clawback: Money the NHS might ask the seller (or you, if not checked properly) to pay back if they think too much was paid for NHS treatments.

- TUPE: Transfer of Undertakings (Protection of Employment) rules that protect existing staff when a business is sold. You can’t just fire everyone and start fresh.

- Regulatory Compliance: Following the rules set by the government and professional bodies (like CQC and GDC) so you don’t get fined, shut down, or face legal trouble.

- Leasehold vs Freehold: Leasehold means you’re renting the property the practice is in. Freehold means you own it. Big difference in responsibility and cost.

- Valuation: An expert opinion on how much the dental practice is worth based on earnings, assets, and market trends.

- CQC Registered Manager: Someone legally responsible for making sure the practice meets all CQC standards. Can be you or a hired person.

- Seller Financing: When the current owner agrees to let you pay part of the price in installments, instead of borrowing it all from a bank.

About the Author

Neha Jain

Neha Jain is a skilled content writer with a rich background in business and financial knowledge. With a bachelor’s degree in English Literature and Psychology, Neha has honed her writing skills, furthering her expertise with the Content Writing Master Course (CWMC) at IIM SKILLS and a Content Marketing Certification from HubSpot Academy.

Working alongside our business development experts, Neha specialises in helping accountants, dentists and other healthcare professionals start, scale and sell their businesses.

Reviewed By:

Buying a Dental Practice: Get Started

When buying a dental practice (especially if it’s for the first time), you need the competent hands of qualified professionals. Not only have we been helping the UK’s dentists to buy, start and sell dental practices for over 20 years, we are dental practice owners ourselves! We know what it takes to buy the right dental practice, we can help you find it, buy it and get it up and running.

Book a free, no-obligation consultation with one of our team at a time that suits you (including evenings). We’ll call you back and have a chat about how we can help buy your dream practice.

With Samera Business Advisors you can rest easy knowing that your investment is secure and your future is brighter. Contact us today so we can help plan for your tomorrow.

Learn More: Buying a Dental Practice

For more information please check out the articles and webinars in the buying a dental practice section of our Learning Centre like the Guide to Buying a Dental Practice.

Make sure you never miss any of our articles, webinars, videos or events by following us on Facebook, LinkedIn, YouTube and Instagram.