- What Will You Need Finance For?

- Buying a Dental Practice

- Dental Practice Valuations

- Buying a Dental Practice

- Starting a Dental Practice

- Start a Dental Practice

- Asset Finance

- Asset Finance

- Commercial Property Finance

- Commercial Mortgages

- Working Capital

- Working Capital

- Tax Loans

- Tax Loans

- Refinancing

- Refinancing and Restructuring Debt

- Bridging Loans

- Bridging Loans

- Dental Finance Loan Types: Summary

- Who Will Lend Finance to Dentists?

- How to Apply For Finance as a Dentist

- Finance for Dentists FAQs

Buying, starting, or expanding a dental practice is one of the biggest financial decisions you will make as a dentist. Whether you’re an associate looking to purchase your first practice, an owner planning to scale up, or simply upgrading your equipment, securing the right financing is key to making it happen.

But with so many options – bank loans, asset finance, commercial mortgages, and alternative lenders – how do you decide what’s best for your situation? And more importantly, how do you increase your chances of getting approved?

In this guide, we’ll break down:

- The main types of finance available for dentists

- How to prepare a strong loan application and avoid common pitfalls

- What lenders look for when assessing your financial health

- Alternative funding options if traditional lenders say no

First, you may find it useful to watch this webinar where we breakdown the important points of how to finance a dental practice, whether it be to start, buy or grow a business.

Key Takeaways:

- Understand Your Financing Options: Whether you’re buying, starting, or expanding a dental practice, there are multiple financing options available, including bank loans, asset finance, commercial mortgages, and working capital loans. Choosing the right one depends on your business goals and financial situation.

- Prepare a Strong Loan Application: Lenders assess your credit score, business plan, debt-to-income ratio, and cash flow before approving a loan. Ensuring your financials are in order, presenting a well-structured application, and working with a finance broker can significantly improve your chances of approval.

- Have a Backup Plan if Rejected: If your loan is denied, ask for feedback, improve your financial health, and address lender concerns before reapplying. Alternatively, explore secondary lenders, specialist healthcare finance providers, or alternative funding options to secure the capital you need.

What Will You Need Finance For?

Buying a Dental Practice

In the vast majority of cases, you will need to borrow money known as acquisition finance to buy your own dental practice.

Lenders will usually lend dentists 70% to 80% of the value of the “good will money” of Private, NHS or mixed practices. However, it is possible to borrow up to 95% of the value.

But usually you must offer some additional collateral in order to perform the transaction, such as a buy-to-let property or your existing residential home.

However, the banks will also take into account the practice’s EBITDA to repay the loan, and cover any additional costs as well as providing the required standard of living adjustments.

It is important to understand what EBITDA is before buying a dental practice. EBITDA is a calculation that professionals use in order to get a clear picture of the “true profit” of their dental practice.

Essentially, EDITDA is: Earnings before Interest, Tax, Depreciation and Amortization. From the profit and loss account: you take the net profit figure (before tax and interest costs), and add back depreciation and any debt interest repayments.

Be very careful not to be misleading when presenting your sales figures. EBITDA has been calculated by adding on items that you will still have to pay – we often see subscriptions, travel, repairs and renewals added back on (they will still be a cost to you going forward). Doing this will inflate the EBITDA, which will jeopardize your loan.

Starting a Dental Practice

If you do not want to buy an existing practice, you may instead opt to start your own squat practice.

Starting a dental practice from scratch means financing a whole range of things you wouldn’t necessarily need to when you purchase an existing practice.

You can easily spend anything from £100,000 to £500,000 and quite easily even more in some cases.

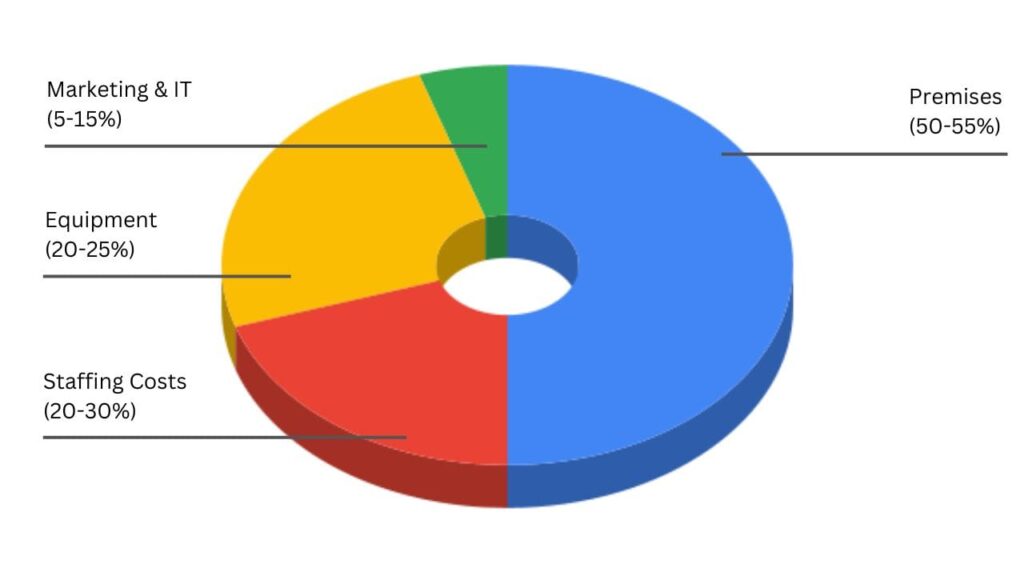

Here is a rough breakdown of what you will need to finance and how much you may need to allocate:

You can learn more about how to finance a squat practice here.

Lenders will usually loan up to 50-80% of the build and equipment costs for a squat practice. The rest of it will usually come from personal savings, but you can also use secondary lenders, friends and family or lines of credit.

You will need to prepare a business plan to show lenders your vision and mission for your new practice. Also, you will need to research the area’s demand for the practice in covering: competition, other local services, hours of opening and provision of services, and other details.

You will also be asked to offer projections of 3 years of income and/or expenditures in a profit and loss format as well as cash flow planning.

Asset Finance

Assets like equipment and consumables can be extremely expensive. Many practices will not have the capital to purchase them upfront. Even when they do, this can make huge dents in the cash flow and may not be the best option.

Asset Finance is a specialised kind of financing that can help fund the purchase or renting of the vital equipment you’ll need to run your practice. It can even be used to free up cash loaned against the value of an asset you own.

There are several kinds of asset finance options including:

- Hire purchase

- Finance leases

- Equipment leasing

- Operating leases

- Asset refinance

Commercial Property Finance

Just like buying a house, most people are going to need some form of financial help when purchasing a commercial property. Whether it is the premises for a new dental practice, expanding a location or purchasing a buy-to-let, you may need to take out a commercial property loan to cover the cost.

Working Capital

A business’s working capital is the amount of ready cash it has to meet its day-to-day operations and debts. Working capital finance is commercial funding specifically designed to boost the working capital available to a business.

Working capital is calculated by subtracting the total of the current liabilities from the value of the current assets. Businesses that cannot meet their expenses or pay their debts will probably need to raise working capital finance. It is most often used for specific growth projects such obtaining a bigger contract or investing in a new market.

When your cash flow takes a hit, you may need to take out a working capital loan to cover the difference and keep yourself afloat.

Tax Loans

Only 2 things are certain in life, and unfortunately, tax is one of them. Taxes are an inevitable cost in any business.

It is normal for a business’ cash flow to fluctuate. However, it is imperative that money is put aside to meet tax obligations. This is where tax loans become an ideal way to spread out a tax demand across affordable monthly repayments without becoming a huge burden on your cash flow.

Sometimes, your tax bill can make a serious dent in your dental practice’s cash flow. For this, and other reasons, your practice may need to raise commercial funding to cover your tax bill.

Refinancing

Refinancing involves restructuring your existing debt to get better terms like reduced interest rates, lower monthly payments, or consolidation of multiple debts.

It is particularly useful for dental practice owners who have taken out loans for equipment, practice acquisition or renovations. Refinancing allows you to save money of repayments and ease the pressure on your cash flow.

- Debt Consolidation: Combining multiple loans into a single loan with a lower interest rate and simplifying payments can potentially reduce the overall debt.

- Interest Rate Reduction: Securing a new loan with a lower interest rate than you already have, saving you money in the long-run.

- Term Adjustment: Extending or shortening the loan repayment term can reduce your monthly payments and reduce the burden on your cash flow.

?

Did You Know?

- It is common for lenders to offer between 70% and 85% of the combined value of the property and goodwill.

- Commercial mortgages for dental practice acquisitions typically range from 15 to 25 years, allowing for manageable monthly repayments.

- The cost of outfitting a new dental practice with essential equipment (dental chairs, X-ray machines, sterilization units, etc.) can easily exceed £150,000.

Bridging Loans

Bridging Loans are a short-term form of commercial funding used by businesses to ‘bridge’ a gap in their cash flow. They can be useful when you need immediate capital, integrate cash flow or make necessary refurbishments. These loans that are priced monthly rather than annually, and lenders may lend anything between £25,000 to £25m.

They are commonly used in commercial property financing and can be a very useful way to raise quick, short-term working capital. Bridging loans are one of the most useful and viable options when you need to move quickly to buy a property.

Dental Finance Loan Types: Summary

| Loan Type | Interest Rate Range* | Typical Repayment Term |

|---|---|---|

| Acquisition Finance | 1.6%-2.6% | 15-25 years |

| Asset Finance | 4-6% | 5-7 years |

| Start-up Finance | 3-4% | 15 years |

| Bridging loans | 10-14% | 1-2 years |

| Commercial Property | 2-2.5% | 15-25 years |

What to do:

- Make a List of Expenses – Create an Excel sheet listing everything you need financing for, such as buying a practice, equipment, renovations, or working capital. Determine what kind of financing you will need to acquire for each expense.

- Calculate the Total Cost – Research prices, get quotes, and add up all costs, including hidden expenses like installation, staff training, or legal fees. You can use our repayment calculator to help you.

- Check Your Borrowing Power – Review your credit score, available collateral (e.g., property), and, if buying a practice, analyze its EBITDA to see what you qualify for.

Who Will Lend Finance to Dentists?

Specialist Healthcare Lenders

Dentists are seen by most financial lenders as low-risk investments. Most of the high street banks have departments specialising in commercial finance for healthcare businesses. Almost all will lend to dentists, but their offerings and terms vary greatly depending on what your requirements are.

For instance, whilst one bank may offer a lower interest rate, they may require more security than another. In addition, new challenger banks are interested in providing loans to dentists, so they are another source to consider for good terms.

Although you can approach them yourself, we strongly recommend you use an experienced commercial finance broker like Samera Finance.

They will help to both find the best deals on the market and improve your chances of having your application approved.

Unfortunately, there is no ‘best bank’ for dental practice loans. It all comes down to what deals or terms work best for you and your business. This is why it is always best to use a professional who is qualified in handling the unique aspects of a dental practice sale and/or purchase.

Most commonly used for:

- Acquisition Finance

- Start-up Finance

- Commercial Property Finance

- Asset Finance

Secondary Lenders

Certain companies specialize in financing dental equipment, acquisitions, and practice growth. These lenders often work closely with dental suppliers and offer finance solutions directly for things like high-cost equipment, mergers and acquisitions and partner buy-ins.

These lenders understand the unique financial structure of dental businesses and offer tailored lending solutions, often with more flexible terms than traditional banks. They are most often used to to cover financial burdens that other lenders (like the banks) will not lend for.

Secondary lenders also provide financing to dentists who may not meet the requirements of traditional banks. They can cater to those with limited business history, lower credit scores, or unique borrowing needs. Unlike high-street banks, they tend to offer faster approval, flexible repayment terms, and higher-risk tolerance – but at the cost of higher interest rates and potentially shorter loan terms.

These lenders can be useful for dentists seeking quick access to capital for equipment purchases, practice acquisitions, or cash flow management. While they can be a lifeline for some, it’s essential to compare terms carefully and assess whether the repayment structure aligns with your practice’s financial health.

Most commonly used for:

- Start-up Finance

- Asset Finance

- Working Capital

Short-term Lenders

Short-term lenders specialise in providing finance on a shorter repayment basis than banks or secondary lenders. They are most often used for things like bridging loans where a quick financial stop gap is needed.

They usually have a much faster application process than other lenders. However, this will come with higher interest rates and shorter repayment times.

Commercial Finance Lenders: Summary

| Lender Type | Pros | Cons |

|---|---|---|

| Specialist Healthcare Lenders | ✅ Lower interest rates than secondary or short term lenders. ✅ Flexible loans, fixed and variable loans ✅ High Loan to Values (LTVs) ✅ Reputable and stable organisations ✅ Access to a wide range of products and services ✅ Long repayment periods | ❌ Strict lending criteria – requires strong credit history & financials. ❌ Longer approval process. ❌ May require significant collateral. |

| Short Term Lenders | ✅ Fast approval ✅ Can offer short term loans ✅ Will lend for purposes not covered by specialist lenders | ❌ Higher interest rates than banks. ❌ Shorter repayment periods ❌ Often penalties for paying early ❌May require security |

| Secondary Lenders | ✅ Can lend over long periods ✅ More flexible with credit history & financials. ✅ Can offer short-term loans and alternative financing solutions. ✅ Will lend for purposes not covered by specialist lenders | ❌ Higher interest rates than both high-street and specialist lenders. ❌ Shorter repayment terms. ❌ Some lenders may have ❌ Higher fees or stricter penalties. ❌ Will require security (property) |

Using a Commercial Finance Broker

No matter where you get your commercial finance from, it’s essential you use an expert finance broker to help you.

When you use a commercial finance broker like Samera, you tap into our decades of experience in the healthcare finance market. Remember, it’s not just about finding a deal for you, it’s about everything else the broker will do for you.

A broker can:

- Negotiate much more effectively, since we know the different structures and formats of deals and applications that lenders look for.

- Find a wider range of finance options using our network of contacts throughout the UK’s lending market

- Spot when a deal isn’t right for your business

- Help with your application process and submission

What to do:

- Make a List of Potential Lenders – Research high street banks, specialist healthcare lenders, and secondary lenders to compare available options.

- Compare Loan Terms & Requirements – Check interest rates, security requirements, repayment terms, and approval criteria to see which lender suits your needs best.

- Reach Out to a Finance Broker – Contact a specialist dental finance broker to source a wider range of options, help negotiate better terms and increase your chances of approval.

How to Apply For Finance as a Dentist

Before Applying

Step 1: Review your personal income and expenditure

The first step is to review your personal income and expenditure – look at it from an outside perspective, and consider what would others think when looking at your expenditure.

Would an outsider consider the £2000 per month you put aside for holidays excessive or just right?

The loan repayment figure you are showing at £1200 per month what does it relate to?

Make sure that you have a breakdown of your debt repayment schedule, showing all your payments, what they are for and who they are going to. Is it all a car loan or made up of some car loan and some professional qualification costs?

Download a free debt structure plan template here.

Step 2: Obtain your Bank statements and look at your account conduct

The second step is to obtain your bank statements and look at your bank account conduct. Do you stay in credit or within the overdraft limit? Are there any times when your finances get really stretched and if so, can you do anything about this?

Step 3: Obtain your Credit Score

Thirdly, obtain your credit score for free and make sure that it is correct. Check there is nothing on there you were not aware of, as credit scoring companies do often make mistakes. If you use multiple credit cards consider reducing the number of cards as having many credit cards can lower your credit score.

Step 4: Consider your partner’s financial background

Make sure your partner’s financial health is strong too. If borrowing in joint names you will both have an examination of your financial status.

Step 5: Contact an experienced Commercial Finance Broker

Utilise the skills of an experienced commercial finance broker such as Samera to help you raise the finance. They will be able to advise you on your options and help you with your application.

Our specialist finance brokers will be able to guide you through the process to ensure you put in the strongest application to the banks and lenders to obtain the best available deals on the market.

Making a Successful Application

Our honest advice for ensuring your application is successful is to use an experienced commercial finance broker like Samera.

That is without a doubt the best way to improve the chances of making sure your application is approved.

A professional broker will know exactly what the banks want to see in your application, how they want it structured and how to get the best chance of being accepted.

You can read more about why you should use a commercial finance broker here.

To get the best chance of being approved for a commercial finance loan, lenders will want to see evidence of strong financials, a solid business plan (if you’re planning to start ot buy a practice), and a clear repayment strategy

Lenders are going to look at your credit score, debt-to-income ratio and both your personal and business cash flow.

It is vital you get your financial situation in order first. That means paying off existing debts and getting the right documentation together.

You also need to make sure you are choosing the right form of finance – whether that be acquisition, working capital, asset finance or a tax loan, depending on your situation and needs.

What to do:

- Organize Your Financials – Pay off outstanding debts where possible, improve your credit score, and ensure your personal and business cash flow is in good shape.

- Prepare Essential Documents – Gather financial statements, tax returns, proof of income, and any required collateral details before applying.

- Create a Strong Business Plan – If applying for practice acquisition or startup financing, outline your revenue projections, market analysis, and repayment strategy.

- Choose the Right Finance Type – Determine whether you need acquisition finance, working capital, asset finance, or a tax loan to match your specific needs.

- Work with a Finance Broker – Use an experienced commercial finance broker who specialises in dentistry to structure your application correctly and improve your chances of approval.

What do Lenders Assess?

How lenders will assess and judge you on will depend on how much you are borrowing and what it is for.

For instance, if you’re borrowing to buy or start a dental practice, they will need to see your experience as an associate, management experience and personal expenses.

If you’re a dental practice owner borrowing asset or working capital finance, they will be more focused on the finances of your existing dental practice(s).

Lenders will usually look at things like:

- The history of any earnings as a dentist.

- Details about your assets liabilities, personal Income and expenditures over the last three years or SA302s – and the appropriate documentation

- Management of personal finances.

- Profit and loss statements (for existing businesses)

- Living situation of the applicant, e.g. is accommodation rented or owned?

- Career in dentistry and level of management experience.

- Ability to repay any loan that is provided.

- Any personal savings that are in place. Showing you can save rather than spend is a great sign to any lender.

- Evidence that tax payments are up to date.

- Sometimes even the personality and character of the applicant.

If you are borrowing to start or buy a dental practice, you’ll need documents such as:

- An up-to-date business plan.

- Up-to-date and accurate accounts (personal and business).

- Up-to-date tax records.

- Details of expenditure.

- Detailed analysis of proposed finance spending and growth of the practice.

If you do not currently own a dental practice, your personal circumstances are one of the information sources that lenders will have to assess your ability to manage a dental practice when you acquire one. They will also look at your CV and whether you have undertaken any roles in your current dental practice to gain skills such as management of staff, accounting or involvement with premises issues and the CQC.

What to do:

- Gather Financial Records – Collect proof of income, tax returns (SA302s), personal and business bank statements, and profit and loss statements (if applicable).

- Show Financial Stability – Ensure your tax payments are up to date, reduce unnecessary expenses, and demonstrate a history of saving rather than excessive spending.

- Prepare Your Business Plan – If applying for practice acquisition or startup financing, create a detailed plan outlining projected income, expenses, and growth strategy.

- Highlight Your Experience – Update your CV with your dental and management experience, showing lenders you have the skills to run a successful practice.

- Check Your Credit & Liabilities – Review your credit report, pay off outstanding debts where possible, and ensure you can demonstrate a strong ability to repay the loan.

What to do if you are Denied a Loan

Hopefully it won’t happen, but there is a chance that your application will be denied. So, what do you do if that happens?

First, you need to understand why you were rejected. Common reasons include low credit score, high debt levels, or insufficient collateral. Ask the lender for specific feedback so you can address the issue.

Next, you have to improve your financial health. Work on boosting your credit score by making timely payments and reducing debt. Strengthen your business finances by managing cash flow, reducing expenses, growing profits or perhaps selling assets.

You can also look at alternative lenders to the traditional, first-tier lenders like banks. However, we would recommend trying to address the concerns of the original lender first, improving on them and reapplying or asking for a reconsideration.

Financing a dental practice, whether you’re starting, buying, or expanding, requires careful planning and the right strategy. With so many funding options available, from bank loans to specialist healthcare lenders and alternative finance, the key is to understand your financial position, prepare a strong application, and choose the best funding solution for your needs.

By following the steps outlined in this guide, you can:

- Identify the right type of financing for your practice

- Improve your chances of loan approval with a well-prepared application

- Explore alternative options if traditional lenders don’t work out

If you’re unsure which funding route is best for you, book a free call with our commercial finance brokers. Our team specializes in helping dentists secure the right financing—get in touch today to find out what your options are.

What to do:

- Ask for Feedback – Contact the lender to understand why your application was rejected, whether due to credit score, debt levels, or insufficient collateral.

- Improve Your Financial Health – Work on increasing your credit score, reducing existing debts, and strengthening your business finances by managing cash flow and cutting expenses.

- Address Lender Concerns & Reapply – If possible, fix the issues identified by the lender and submit a stronger application with improved financials and documentation.

- Explore Alternative Lenders – If traditional banks won’t approve you, consider specialist healthcare lenders, secondary lenders, or other finance options that may have more flexible terms.

- Consult a Finance Broker – Work with a specialist dental finance broker to refine your application and find lenders that are more likely to approve your loan.

Our Expert Opinion

“There are so many options to borrow money on various terms these days which can be confusing. The cheapest rate is often not the best deal available, As loan to value, term of loan, arrangement fees, exit fees and legal fees are all things that need to be considered. That’s why now more than ever it’s essential to have a commercial finance broker assist to get the best deal, not just the best rate.”

Finance for Dentists FAQs

What is Loan-to-Value (LTV) and how does it impact my loan?

Loan-to-Value (LTV) is a ratio used by lenders to determine how much they are willing to finance in relation to the total value of the practice or property you are purchasing.

Example:

- If a practice costs £500,000 and a lender offers an 80% LTV, they will lend £400,000, and you must provide £100,000 as a deposit or additional security.

- Higher LTV ratios (e.g., up to 95%) may be available if you offer additional collateral, such as personal property or other assets.

A lower LTV means less risk for the lender, which can lead to better loan terms (lower interest rates, longer repayment terms). A higher LTV may require more personal guarantees or higher interest rates.

What is Goodwill in a Dental Practice Sale?

Goodwill represents the intangible value of a dental practice, including:

- Patient Base: The number of loyal, returning patients.

- Brand Reputation: How well-known and respected the practice is.

- Location Value: Prime locations increase goodwill value.

- Existing Staff & Operations: An established, well-functioning team adds goodwill.

Goodwill vs. Tangible Assets:

Lenders usually finance 70-80% of goodwill value, but this varies based on risk and EBITDA (earnings before interest, tax, depreciation, and amortization).

When buying a practice, the purchase price typically consists of tangible assets (equipment, property) + goodwill.

What are the tax implications of financing a dental practice?

Financing a dental practice can have several tax benefits, including:

- Interest on Loans: Interest payments on business loans are tax-deductible.

- Asset Depreciation: Equipment purchased through asset finance can be written off over time.

- Goodwill Amortization: In some cases, goodwill can be amortized for tax benefits.

Always consult a specialist dental accountant to maximize tax efficiency when structuring your loan and practice purchase.

What are some common mistakes to avoid when applying for a practice loan?

- Overestimating EBITDA: Lenders scrutinize financials; inflating numbers will backfire.

- Poor Credit History: If your personal credit score is weak, address this before applying.

- Incomplete Business Plan: Lenders want detailed growth plans, financial projections, and risk mitigation strategies.

- Not Exploring All Lender Options: Consider high-street banks, specialist lenders, and secondary lenders to find the best terms.

Can I get financing if I’m a new dentist without ownership experience?

Yes, but expect stricter lending criteria. Lenders prefer borrowers with:

- At least 3-5 years of associate dentist experience.

- Some management experience in a dental practice.

- A well-detailed business plan proving you can run a practice successfully.

New dentists may need:

- A higher deposit or lower LTV loan.

- A co-signer or business partner with financial experience.

- To work with specialist healthcare lenders who understand the industry.

What happens if I default on a dental practice loan?

If you default, lenders may:

- Seize collateral (if the loan is secured by property or equipment).

- Take legal action to recover the outstanding amount.

- Damage your credit score, making future borrowing harder.

To avoid default:

- Maintain good cash flow management.

- Keep a financial buffer for emergencies.

- Consider refinancing if repayment becomes difficult.

Can I refinance my dental practice loan to get better terms?

Yes! Refinancing allows you to:

- Lower interest rates (if your financials have improved).

- Extend loan terms to reduce monthly payments.

- Consolidate multiple debts into one easier repayment.

However, refinancing may incur fees for early repayment, so always calculate the long-term savings vs. costs.

Should I apply for multiple loans at once to increase my chances?

No – applying for multiple loans at once can harm your credit score and make lenders wary. Instead:

- Research the best lender for your specific needs.

- Work with a finance broker to match you with the right lender.

- Apply for one loan at a time to avoid multiple hard credit checks.

What can I do if my personal finances are not strong but I need a loan for my practice?

If your personal credit score or finances are weak, you can:

- Use a business partner with strong financials to co-sign the loan.

- Offer additional collateral to reduce lender risk.

- Improve cash flow in your current job/practice before applying.

Some specialist lenders focus only on business viability, so weak personal finances may not be a deal-breaker.

About the Author

Neha Jain

Neha Jain is a skilled content writer with a rich background in business and financial knowledge. With a bachelor’s degree in English Literature and Psychology, Neha has honed her writing skills, furthering her expertise with the Content Writing Master Course (CWMC) at IIM SKILLS and a Content Marketing Certification from HubSpot Academy.

Working alongside our business development experts, Neha specialises in helping accountants, dentists and other healthcare professionals start, scale and sell their businesses.

Reviewed by:

Arun Mehra

Samera Founder & CEO

Arun, founder and CEO of Samera, is an experienced accountant and dental practice owner. He specialises in accountancy, building businesses, financial directorship, squat practices and practice management.

Business Loans for Dentists

We’ve been helping to fund the future of the UK’s dentists for 20 years and our team are made up of former bankers with decades of experience and contacts in the UK’s healthcare lending sector.

You can find out more about working with Samera Finance and the financial services we offer by booking a free consultation with one of the Samera team at a time that suits you (including evenings) or by reading more about our financial services at the links below.

Contact Information

Fill in the form and our team will get back to you as soon as possible.

or

or

Dental Practice Finance: Further Information

For more information on raising finance for your dental practice, including more articles, videos and webinars check out our Learning Centre here, full of articles an webinars like our How to Guide on Financing a Dental Practice.

Make sure you never miss any of our articles, webinars, videos or events by following us on Facebook, LinkedIn, YouTube and Instagram.