Business Loans for UK Dentists

With over 20 years of experience, we specialise in finding the best commercial finance deals on the market for dentists.

Are you a dentist looking for commercial finance to start, buy, or grow your dental practice? At Samera Finance, we specialise in helping dentists secure the right business loans on the best terms.

20+ Years Experience

100’s of Dentists Helped

Over £100 Mil Raised

We have been helping the UK’s dentists raise and manage finance for over 20 years. Our team of experienced finance brokers understand the UK dental sector inside and out. We use that expertise to work with lenders across the whole UK market and make sure you find a finance deal that works for you.

Getting started is simple. Share a few details with us and, once approved, we’ll source the most suitable funding packages for your practice. The process is quick, secure, and designed to make the process easy.

Apply for Commercial Finance Now

It couldn’t be easier to get your finance application started. You can either book a free, no-obligation consultation with one of our finance brokers, or apply via our website or app.

All you need to do to apply is sign up, provide a few key details and documents and we’ll get to work finding the best deals on the market for you to choose from.

Uros Turcic

Commercial Finance Broker

Speak to an expert

To find out more about what your options are and how we can help you, book a free consultation with Uros – one of our commercial finance brokers specialising in UK dentists.

Speak with UrosEstimate Your Dental Practice Loan Repayments

What We Can Help Dentists Raise Finance For

No matter what you need finance for, we can help find the deal that suits you. From acquisition and start-up finance to asset finance and tax loans. Our FCA-authorised finance brokers specialise in securing the best terms available on the market

Apply for Dental Practice Finance in 5 Quick Steps

In these 5 quick and easy steps, you can find out what your options are, how much it will cost and which finance deal is right for you.

1

Book Your Free Consultation

Talk to our team about what you’re looking to finance – whether it’s buying a practice, purchasing equipment, refurbishing a practice or covering cash flow. We’ll help you figure out what your options are.

2

Sign Up on the Samera Finance App

Create your profile and start your application journey. The process is quick and easy. The app keeps everything organised and secure, making it easy to manage your progress.

3

Gather Your Paperwork

We’ll guide you through what’s needed – usually things like accounts, bank statements, and ID. Simple and checklist-driven.

4

Submit Everything in One Place

Upload your documents directly through the app – no printing or email chains required.

5

Choose the Right Funding Option

We’ll get to work searching the market and present the most suitable offers. You decide which one best fits your goals and budget.

Why Dentists Choose Samera Finance Brokers

We are one of the UK’s most trusted commercial finance brokers and we specialise entirely in the dental finance sector.

We know exactly what the banks want to see in an application, we know when a deal is too good to be true and we know when a deal can be beaten.

Being an independent broker, we approach a wide range of banks and alternative lenders to ensure we find a deal that most benefits your business.

- 20+ years’ experience working with UK dentists

- Over £100 million raised in dental practice finance

- Hundreds of dentists successfully supported

- FCA-authorised and NACFB member

- Shortlisted for NACFB Commercial Mortgage Broker of the Year 2021 and 2022

- Strong relationships with all major healthcare lenders

- Streamlined process via the Samera Finance App

Client Testimonials

“It took only days to get the finance in place and furthermore … has gone over his remit in helping me along the process with valuable advice that saves me much time and money! Basically if you want a result call Samera!”

I would give him 10 stars if I could. Very knowledgeable and helpful throughout the whole process. Stress free from beginning to end. I would Highly recommend him to anyone.

Originally recommended by a close friend for commercial finance but ended up helping will all aspects of my first practice purchase- from sifting through prospectuses, business plans, viability and securing great deals on the loans. No question was too silly and he was available around the clock. Thoroughly appreciate having honest expert advice in what typically is your most expensive purchase.

An absolute pleasure. His extensive industry connections enable him to find the best deals available, and his responsiveness and approachability make the entire process seamless. Highly recommended for anyone in need of a reliable finance broker!

I can’t thank … enough for helping me get a good deal on a mortgage for my second dental practice. He has been so patient with me. And he’s always been available for chat when I needed one.

“Very quick to get me the finance I had struggled for several years to get. I will definitely be using this service again in the future!”

“Great service, really paid attention to our needs and offered us the appropriate advice. In particular we were impressed with the time, dedication and focus given to help us finance our acquisition of a dental practice with good rates. We also managed to stay in communication during unsociable hours which really made the process convenient for us. Very helpful.”

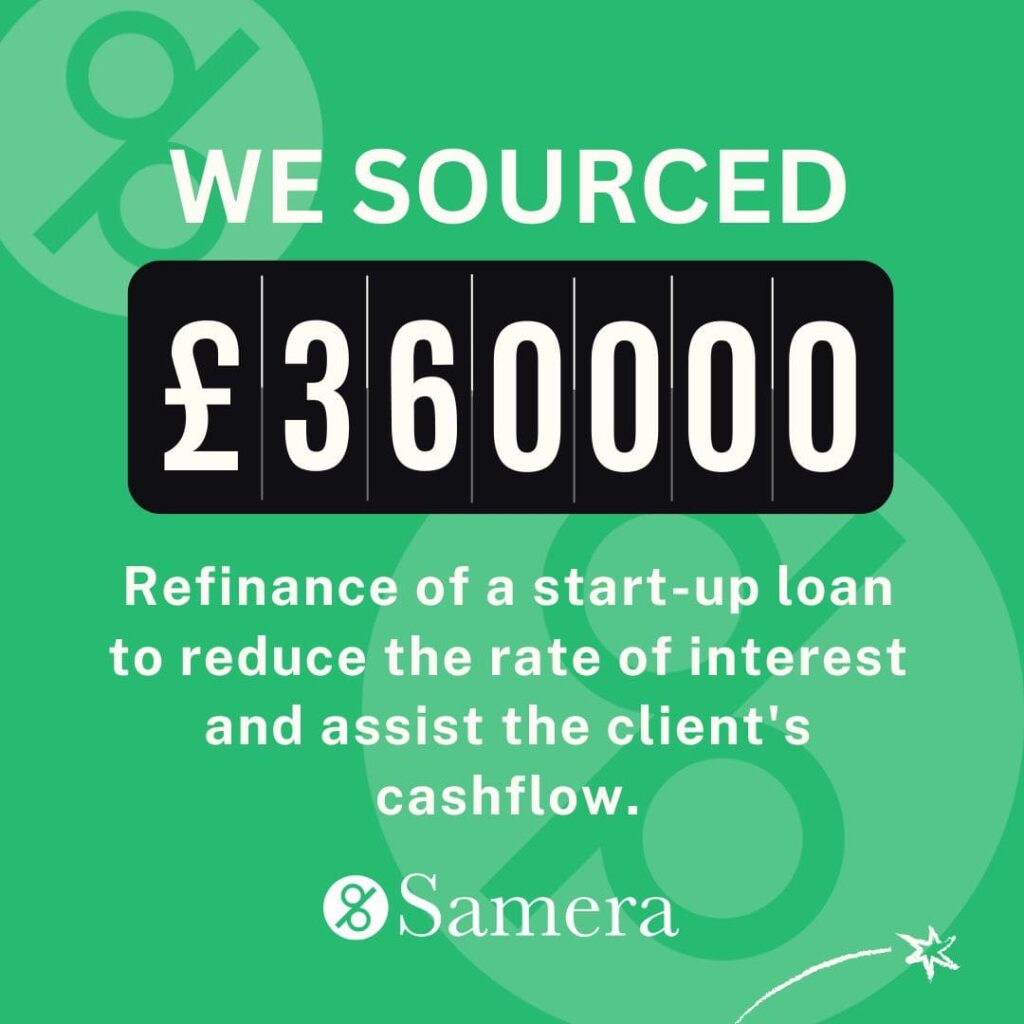

Our Recent Deals

Who We Work With

We are an independent commercial finance broker. We work solely for you and are not tied to any lenders. Our extensive network in the UK’s lending sector lets us shop around the entire industry to find you the best options.

Samera Finance is registered with the FCA (Financial Conduct Authority) and is also a member of the NACFB (National Association of Commercial Finance Brokers), as well as being a panel member of all the major lenders, which enables us to introduce clients to them.

Become a partner

Learn More About Dental Practice Finance

FAQ’s

Do you have further questions?

If so, please send us a message via our contact form.

How do I apply?

All you need to do is sign up and fill in the required forms. The process is quick, streamlined and only takes a matter of minutes. Once we have assessed and approved your application we will get to work sourcing the best business loan for you.

What different kinds of business loans are there for dentists?

There are several different forms of finance available to you. Which business loan is right will depend on factors such as what you need the loan for and your ability to repay it.

These are some of the different options available to you:

Acquisition finance:

Acquisition finance funds the purchase of an existing business or shares in a business. Whether you want to buy your first dental practice, buy shares in an existing practice or buy a second practice t o start a dental group, you will most likely need to borrow acquisition finance.

Asset finance:

Asset finance is used to purchase equipment for a dental practice. You can use it to finance dental chairs, scanners, CBCT machines etc. Any equipment you need to run your practice can be funded with asset finance – even your car!

Refinancing:

Sometimes you can get more favourable terms on your loans by refinancing the debt. This means that you can renegotiate factors such as the interest rate or the payment schedule by taking out a new loan with better terms to cover the old one.

Commercial mortgages:

A commercial mortgage is simply a mortgage used to purchase a commercial property, like the site for a new squat dental clinic or a new premises for your expanding practice. Commercial mortgages can be repaid over 15/20/25 years and allow you to spread your payments over the life of the business.

Tax loans:

Sometimes, an unexpectedly heavy tax bill can create a huge hit in your working capital. When this happens, it can be better to spread the cost of your tax bill over the year with a tax loan. This loan covers the immediate bill and allows you to pay in smaller, monthly instalments.

Working capital and cash flow loans:

When your working capital takes a hit, your cash flow can be reduced drastically. When you have to dip into your working capital for an unexpected purchase, it may be best to borrow the money instead. This way you can spread the cost across the year, rather than taking it all out of the working capital in one go.

How does taking out a business loan work?

When you take out a business loan, you borrow the money in a lump sum and pay it back in installments (plus interest payments). This allows you to make purchases you otherwise would not be able to afford, and also spread that cost over a longer period of time.

Loans are usually either paid back over a short term (2 years or less) or long term (3 years or over).

You also have the option in many cases to borrow a secured or unsecured loan. A secured loan is one which you guarantee with collateral. What this means is that you borrow the money against the value of an asset the business owns, such as a property.

If you fail to repay the loan the lender will take the asset to recoup their loss. An unsecured loan does not require collateral, however, they usually come with less favourable terms. This is because the risk to the lender is greater.

Am I eligible for a business loan?

To find out if you are eligible to take out a business loan, simply click ‘apply now’, fill in a few forms and we’ll let you know how much you could possibly borrow. Any loan is, of course, dependent on the business having the ability to meet the payments

Lenders, such as the banks, like lending to healthcare businesses like dentists. Get your applications, your financial forecasts and your business plan right and we can help you find the right business loan for your business.

What information will I need to provide to the lender?

Lenders will want to see a range of information and documentation. It is essential that you get this step correct. The lenders will reject your application if the projections are wrong, the business plan is poorly done, you have a poor financial record, and that’s just a few reasons.

The banks will want you to be able to provide evidence of:

- Your previous earnings in your healthcare field.

- How you handle personal finances.

- Your living situation, whether you own or rent your home.

- Career in healthcare so far and any management experience.

- Ability to repay any loan.

- Personal savings

- Tax payment records.

To find out more about making sure your loan application is successful, click here.

I’ve been denied a healthcare business loan before, can I still apply?

Yes, even if you have been denied before we can still help you.

If you have had a business loan application rejected in the recent past, you may need to improve your credit rating and financial standing before you can reapply.

Or, it may be that you were not talking to the right people! You may need to approach alternative lenders or adjust your application and business plan.

Contact us today to find out how to improve your chances of applying for a business loan.

How easy is it to take out a business loan as a dentist?

Applying for a business loan is not always an easy business. Even when it is, there’s no guarantee that the loan you take out is the best available.

To make the process easier, increase your chances of a successful application and ensure you get the best deal around, we have created the Samera Finance app.

We have been working in the healthcare finance market for decades. We know how to format your application, who to approach and how to negotiate the best deal, thanks to our extensive experience and contacts.

Applying for a business loan for your dental business is easy when you use Samera Finance to do the hard work for you.

How much can I borrow for my dental business?

The amount you can borrow will depend on a wide range of factors. These include your ability to repay the loan, what you intend to use the money for and your current financial situation.

Samera Finance can help source loans to cover small purchases for consumables and small assets, as well as larger loans to purchase property or another business.

Use our finance calculator above to see how much you can borrow.

What information will I have to provide when I apply?

The information we require will vary case by case, depending on what kind of loan you need and what you intend to use it for.

This is a basic list of the kind of information we will require:

Personal

- Personal Profile Form – details income and expenditure

- Personal Banks Statements – last 6 months

- Last 3 years associate accounts

- CV

Business

- Last 3 years practice accounts

- Practice Management information – if available

- Practice sales particulars

- Business plan

- Projections may be required

What is the interest rate for a business loan?

The interest rate you get will vary case by case. It depends on what you borrowed money for, who you borrowed from and the terms of your loan.

For instance, the average interest rate for an acquisition loan to buy a dental practice is typically around 2% – 3% above base rate. But the rate for a start up loan for a squat dental practice may be closer to 4% – 5% above base rate.

However, Samera Finance can help negotiate the interest rate to make sure you get the best price available.

How soon will I need to start repaying the loan?

When you need to begin repaying your business loan will depend on the terms of your loan agreement.

In many cases, you will need to start repaying the next month after receiving the money.

However, we may also be able to negotiate a repayment holiday, where you have a grace period of around 6-12 months before you need to begin repayment.

How long will I be repaying my business loan?

The payment schedule for your loan is known as the term length. The term length will depend on what you negotiate in the application, as well as the kind of loan you are borrowing.

Some loans, such as bridging loans, are repaid within 12 months. Other short term loans will be repaid within 2 years. Long term loans over a period of longer than 3 years.

Remember that it is often the case that the longer the term length, the lower the interest rate you will pay.

What is a fixed interest rate loan?

A fixed interest rate means that the interest rate will remain the same throughout agreed period of the fixed-rate repayment schedule.

Therefore, if the Bank of England base rate rises, your payments will not be affected – since your interest rates are fixed. This means you can more easily budget your cash flow, knowing these payments remain fixed.

However, this does also mean that your interest rates will remain the same if the Bank of England base rate falls.

What is a variable interest rate loan?

A variable interest rate is one that can fluctuate according the to Bank of England base rate . This means that if the Bank of England base rate falls or rises, so too will your loan interest rate.

Although this can sometimes mean your interest rates fall, it also makes your payment schedule hard to predict.

If the Bank of England base rate rises unexpectedly, you may find yourself with an unexpected hit to your cash flow.

Does Samera Finance lend money?

No, we are not a financial lender.

Samera Finance is a commercial finance broker. That means that we use our network and connections within the UK healthcare lending industry to find the best loans and negotiate the best terms.

We find the right finance, make sure your application is right, negotiate the terms and ensure you get the best loan for the right price.

What is a finance broker and why do I need one?

A commercial finance broker like Samera acts as an intermediary between you and the lender. We do not lend the money ourselves.

We use our network of contacts in the UK’s lending sector, as well as our experience in loan applications, to ensure you find the best deal.

Although you can apply for a loan and raise the finance yourself, with a commercial finance broker you will find a wider range of finance options, have a better chance of a successful application and negotiate better terms.

Contact us to Get the Best Finance Deal

Contact Information

Fill in the form and our team will get back to you as soon as possible.

or

or