Managing a Growing Team Effectively

In this module, we’ll explore how accounting firm owners and managers can approach team growth with clarity, structure, and confidence.

The team is the bulwark of any accountancy firm. As your practice expands, the way you manage your team will directly impact the quality of service, internal efficiency, and long-term scalability. Managing a growing team effectively is not just about delegation or oversight, it’s about setting up the right systems, expectations, and culture that align with your firm’s objectives.

In this module, we’ll explore how accounting firm owners and managers can approach team growth with clarity, structure, and confidence.

Key Takeaways

- Growing an accounting firm requires changing team management from individual oversight to structured systems and clear leadership.

- Maintaining quality, vision alignment and managing complex operations are the key challenges you’ll face in a growing team.

- Invest in clear roles, positive culture, streamlined communication and ongoing development to improve employee morale and your firm’s productivity.

- Take a step-by-step approach covering defined roles, team culture, communication, on-going training, task delegation, company-wide processes, recognising performance, mediating conflict and clear leadership.

- Adaptable and proactive leadership, focused on continuous improvement and anticipating challenges, is crucial for the long-term success of a growing accounting firm.

Introduction

Growing from a small, close-knit team to a larger, more structured operation brings a new layer of complexity. What worked when you had three or four people around a table no longer holds up when you have multiple teams, remote staff, or offshore operations.

At this stage, your firm’s success hinges on more than just technical expertise. It depends on your ability to lead, delegate, communicate, and build systems that support sustainable growth. A growing team brings fresh opportunities, but it also demands clarity in roles, consistency in delivery, and strong leadership at every level.

This chapter focuses on how to manage that growth effectively. We’ll explore the common team management challenges that accounting firms face as they expand, why leadership and structure matter more than ever, and how you can implement practical steps to create a well-aligned, high-performing team.

Unique Challenges of Managing a Growing Accounting Team

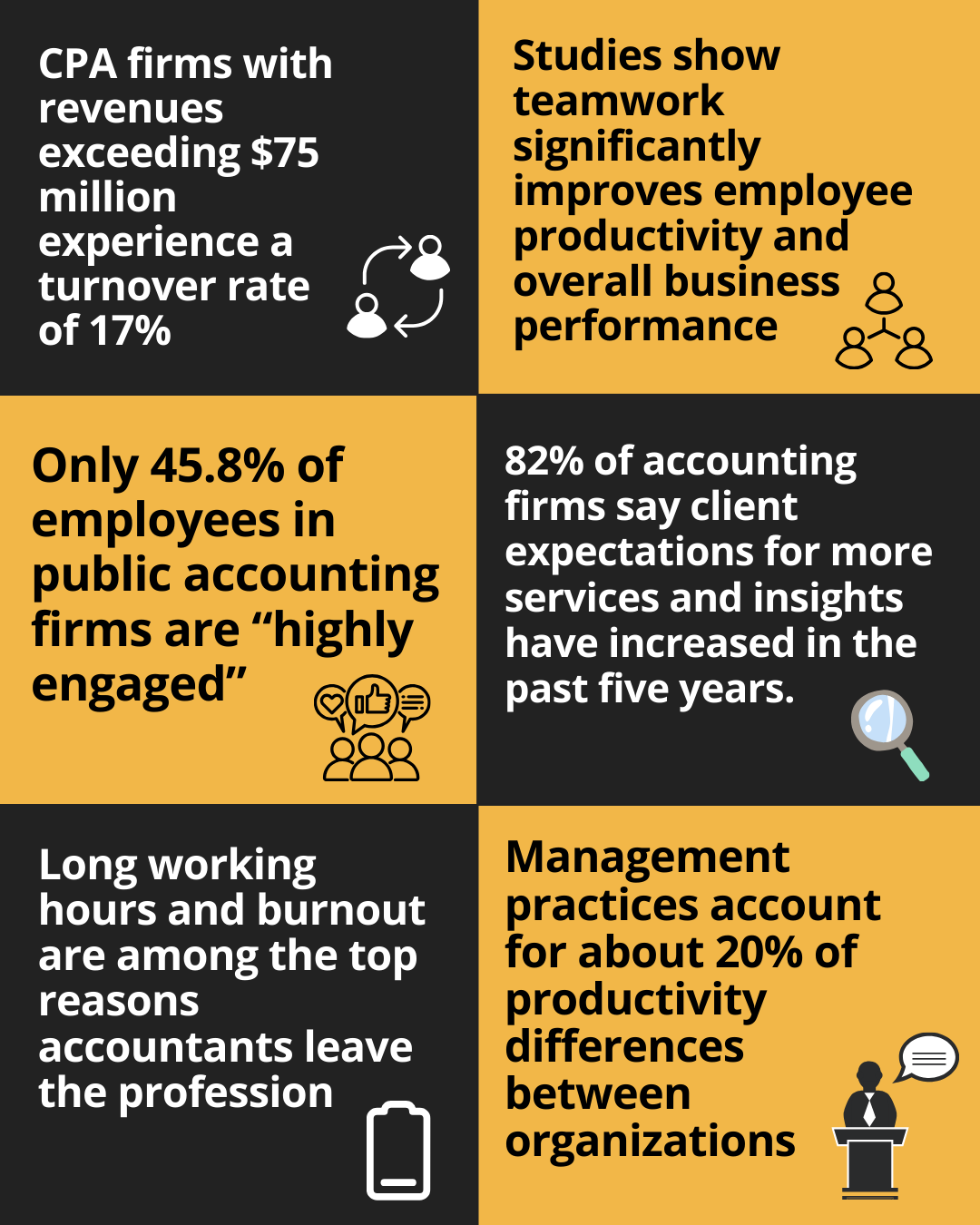

CPA firms with revenues exceeding $75 million experience a turnover rate of 17%, with one in every six firms facing annual turnover challenges [1]. As your client base increases and service offerings expand, new challenges emerge in team dynamics, operations, and communication. These are the five key challenges accounting firms commonly face:

- Maintaining quality control and consistency: As you bring in new team members, it becomes harder to maintain consistent output across bookkeeping, tax preparation, and management accounts. Without the right review systems and templates, errors can slip through and impact client trust.

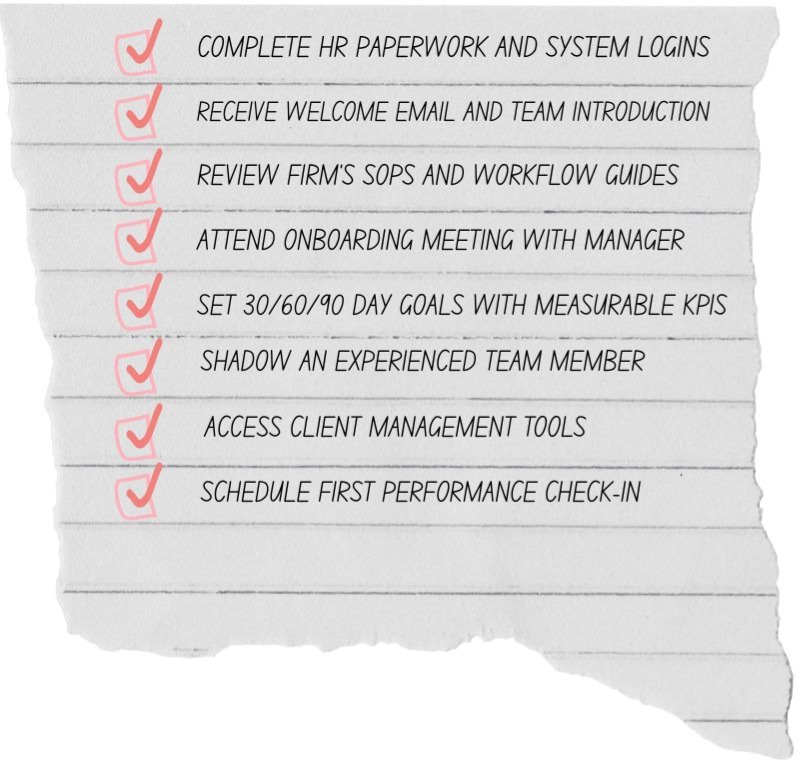

- Managing knowledge transfer and onboarding: New hires require structured onboarding, training, and clear documentation of firm processes. Without this, productivity drops and new team members struggle to integrate into workflows.

- Communication breakdowns across teams: As the team size grows, especially in remote or multi-location setups, internal communication becomes fragmented. This can lead to duplicated work, missed deadlines, or lack of ownership.

- Undefined roles and responsibilities: Many small firms scale quickly without redefining who is responsible for what. This leads to overlap, confusion, and inefficient task allocation.

- Retaining top talent in a competitive market: Accounting professionals today look for more than just a payslip. Career progression, work-life balance, and meaningful engagement are vital to reduce turnover and maintain firm stability.

Strong Leadership and Team Management for Sustainable Growth

Effective leadership and structured team management are essential for any accounting firm looking to scale sustainably. Here’s why:

- It creates operational clarity: With clear leadership and workflows, team members understand expectations, reporting structures, and performance standards, leading to higher productivity and fewer bottlenecks.

- It drives client service excellence: When teams are managed well, they are more accountable, responsive, and aligned with client needs. This translates directly into improved client satisfaction and retention.

- It enables scalable growth: Firms with strong internal management systems can add new clients and team members without chaos. This makes it easier to expand services or enter new markets, including offshoring and outsourcing operations.

Brief Overview: Principles and Actions for Effective Team Management

In the sections that follow, we’ll break down the practical elements of managing a growing accounting team. We’ll cover:

- How to build a clear team structure that aligns with your service model

- Setting up performance tracking and KPIs for accounting roles

- Developing onboarding and training frameworks

- Implementing communication and workflow tools

- Creating a positive work culture focused on accountability and growth

Each principle is backed by actionable steps tailored for accounting firm owners and managers. Whether you’re running a small local practice or scaling with offshore teams, these strategies will help you lead with confidence and build a resilient, high-performing accounting business.

The Dynamics of a Growing Team

More people mean more moving parts, new roles, new personalities, and new challenges. Managing this shift is crucial if you want your firm to remain efficient, client-focused, and growth-ready.

This chapter explores how team growth affects your firm’s culture, communication, and productivity, and identifies the core challenges that must be addressed to maintain quality and alignment as you scale. Understanding these dynamics will help you lay the groundwork for smoother operations and a stronger, more cohesive team structure.

How Team Growth Impacts Culture, Communication, and Productivity

When your team grows, everything from how people interact to how work gets done changes. If not managed carefully, these changes can lead to operational inefficiencies and a decline in team morale.

But with the right structure and awareness, growth can drive better performance and stronger results. In fact, a study found that teamwork significantly improves employee productivity and overall business performance [2].

Here’s how it typically plays out in an accounting business:

- More team members equals more communication layers: As your team grows, direct communication becomes harder. What was once a quick chat turns into an email chain or a scheduled meeting. This can slow down decision-making and lead to misunderstandings if not streamlined with tools and processes.

- Culture shifts from informal to structured: In a small team, culture builds naturally. As you scale, culture needs to be shaped intentionally. This includes defining values, setting behavioural expectations, and ensuring leadership models the right tone.

- Productivity becomes dependent on systems, not individuals: Initially, a few high-performers can carry the team. But in a larger team, productivity relies on standardised workflows, checklists, and review systems, especially in tasks like bookkeeping, tax compliance, and reporting.

- More room for silos to develop: Without cross-functional communication, teams start operating in isolation, bookkeeping, accounts production, and client support don’t talk to each other. This leads to disjointed service and wasted effort.

- Role clarity becomes essential: In small teams, everyone wears multiple hats. In larger teams, blurred responsibilities lead to confusion and duplicated work. Defined roles and clear job descriptions help streamline task management and accountability.

- Greater need for documentation and knowledge sharing: Firm processes need to move from being in someone’s head to being documented and accessible. This ensures continuity when team members go on leave or move on, and helps new hires get up to speed quickly.

- Increased demand for leadership and people management skills: Technical skills alone aren’t enough anymore. Managers must know how to give feedback, run team meetings, address performance issues, and motivate people, skills that many accountants haven’t been trained for but must now learn.

Key Challenges of Scaling With a Growing Team

Scaling your team isn’t just a numbers game. Each new hire adds complexity that must be managed proactively. Only 45.8% of employees in public accounting firms are “highly engaged,” revealing room for better team management and morale-building strategies [3].

Here are three of the most common challenges faced by growing accounting firms:

Maintaining consistency in quality

When your team was smaller, quality control likely happened informally, reviewing files personally, correcting small errors as they came up, or having direct oversight over most client interactions.

But as you grow, especially with layered teams or offshore units, this direct control is no longer feasible. Inconsistent quality across deliverables, whether it’s bookkeeping, year-end accounts, or VAT returns, can quickly erode client trust and cause compliance risks.

Practical Impact on the Firm:

- Errors and rework slow down turnaround times and reduce margins.

- Clients lose confidence when they see varying standards across services.

- More senior staff end up firefighting instead of focusing on growth or client advisory.

Strategies to Manage This:

- Develop standardised processes and checklists for core services. For example, a monthly bookkeeping checklist that every team member follows regardless of location or experience level.

- Implement a structured review workflow. Junior or mid-level staff complete the work, and a reviewer signs off using pre-set quality benchmarks.

- Use templates and firm-wide formatting guidelines for client reports, management accounts, and tax summaries to ensure uniform presentation.

- Run periodic file reviews, randomly pick client files each month to audit for completeness and accuracy. Use findings for coaching.

The key takeaway here is that you can’t scale quality with intuition. You need systems. Build a repeatable structure that makes consistency inevitable, even when you’re not watching every file.

Ensuring alignment with firm goals

In small teams, the owner’s vision naturally permeates everything. But as you hire more people, especially across departments or locations, individuals may not fully understand, or feel connected to, the broader business goals. They may focus only on ticking off tasks, without seeing how their role contributes to client satisfaction or firm growth.

Practical Impact on the Firm

- Misalignment can lead to staff focusing on low-value work while ignoring more strategic priorities.

- Lack of ownership and engagement leads to poor morale and higher turnover.

- Firm-wide initiatives (e.g. client service upgrades, tech transitions) struggle to get buy-in.

Strategies to Manage This:

- Hold regular internal meetings or huddles where leadership shares firm updates, performance progress, and the “why” behind key decisions.

- Use KPIs that link individual performance to team or firm-level outcomes. For example, tracking turnaround time, client feedback, and internal error rates.

- Build goals into performance reviews. Make it clear how each team member’s work feeds into the firm’s mission, whether that’s doubling recurring revenue or expanding advisory services.

- Create a firm vision document or internal knowledge base that explains your core values, growth targets, and client service standards.

Alignment doesn’t happen once a year, it needs constant reinforcement. The more your team understands the bigger picture, the more they contribute meaningfully, not mechanically.

Addressing increased complexity in operations

As team size and client volume increase, so does operational complexity. 82% of accounting firms say client expectations for more services and insights have increased in the past five years [4].

Tasks multiply, client requests become more frequent, and you find yourself juggling deliverables across time zones, staff schedules, and software platforms. Without a defined operational backbone, work becomes chaotic, and small delays or miscommunications can snowball into larger issues.

Practical Impact on the Firm:

- Deadlines get missed or overlap.

- Resource planning becomes guesswork.

- Client communication becomes reactive, not proactive.

Strategies to Manage This

- Invest in the right project management software. Platforms like Karbon, Asana, or Pixie allow visibility across tasks, deadlines, and capacity, especially useful in firms with remote or offshore staff.

- Adopt integrated accounting ecosystems. Choose software that connects client work (like Xero or QuickBooks) with internal tools for time tracking, billing, and task management.

- Introduce workflow documentation. Map out each recurring process, like client onboarding, VAT filing, or month-end management accounts, so everyone knows the steps, handoffs, and timelines.

- Use automation where possible. Automate routine communications (e.g., client reminders for documents) or recurring internal tasks (e.g., month-end report generation).

Operational complexity is a natural byproduct of growth, but chaos doesn’t have to be. With the right systems and visibility tools, you can manage complexity before it manages you.

Common Team Management Problems and Solutions

| Challenge | Solution |

|---|---|

| ❌ Unclear roles and responsibilities | ✅ Define job descriptions, reporting lines/hierarchy and expectations for each team member clearly. ✅ Host regular feedback sessions with managers and frontline staff. ✅ Update these procedures and responsibilities regularly as your team evolves. |

| ❌ Declining quality control | ✅ Standardise processes with checklists for key services like tax returns and bookkeeping. ✅ Introduce tiered review workflows (e.g. junior → senior → partner). ✅ Run monthly random audits for internal coaching and consistency. |

| ❌ Poor Communication | ✅ Use messaging using tools like Slack or Teams. ✅ Set weekly or bi-weekly team meetings to update, align and plan together ✅ Create shared task boards for real-time updates and accountability. |

| ❌ Knowledge loss during onboarding or turnover | ✅ Build structured onboarding plans with timelines and milestones. ✅ Document key processes in a shared, searchable knowledge base. ✅ Assign onboarding mentors to guide new hires through workflows. |

| ❌ Difficulty retaining talent | ✅ Offer personalized growth paths with role progression criteria. ✅ Provide regular feedback and coaching, not just annual reviews. ✅ Promote flexibility, well-being, and recognition to enhance morale. |

| ❌ Operational inefficiency and complexity | ✅ Use project/task management platforms to track deadlines and workloads. ✅ Automate routine processes like client follow-ups or reconciliations. ✅ Map out workflows visually to improve clarity and reduce duplication. |

| ❌ Lack of alignment with firm goals | ✅ Communicate strategic priorities regularly in internal meetings. ✅ Align individual KPIs with firm goals (e.g., client retention, turnaround time). ✅ Share the “why” behind changes to build buy-in and ownership. |

Final Thoughts

Each of these challenges is solvable, but only if you approach them deliberately. As your accounting firm grows, the key is to evolve how you manage. Systemised quality control, goal alignment, and operational discipline, they’re all competitive advantages.

Benefits of Effective Team Management

Team management isn’t just about delegation or oversight but about creating the right structure, communication flow, and culture that allows people to work confidently and perform at their best. Management practices account for about 20% of productivity differences between organizations, showing the high ROI of effective leadership [5].

In this chapter, we’ll explore how strong team management translates directly into tangible business benefits. From higher retention and morale to smoother operations and improved output, the right team structure can take your firm from functional to high-performing.

Improved Employee Morale and Retention

A well-managed team is a motivated team. When people feel supported, valued, and clear about their roles, they are more likely to stay and perform well. For accounting firms, where client relationships and service consistency depend heavily on experienced staff, retaining your people is as important as acquiring new clients.

Here’s how effective team management directly improves morale and retention:

- Clarity in Roles and Responsibilities: When employees know what’s expected of them, what they’re responsible for and how success is measured, they feel more confident and engaged. In an accounting firm, this means clearly outlining whether a team member is focused on bookkeeping, year-end accounts, client queries, or internal reviews. When there’s no ambiguity, work becomes more focused, and people are less likely to feel overwhelmed or underutilised.

- Regular Feedback and Performance Support: Ongoing check-ins and performance reviews help staff understand where they stand and how they can improve. This is especially valuable in accounting firms where progression often depends on technical growth and accuracy. Constructive feedback builds trust and creates a sense of development, which in turn reduces disengagement.

- Career Development Opportunities: Offering clear pathways for growth, whether through new roles, certifications, or internal mentoring, can significantly improve retention. Many accountants leave firms not because of pay, but because they don’t see a future. A well-managed team includes a structure for learning and advancement, which helps you retain top performers in a competitive industry.

- Healthy Workload Management: Good team management ensures that work is distributed fairly and resources are matched to capacity. Overloading one part of the team while others are underutilised creates friction and burnout. Research shows, long working hours and burnout are among the top reasons accountants leave the profession, reinforcing the need for healthy team management [6]. With clear visibility across workflow and capacity, managers can balance workloads and avoid the fatigue that leads to high turnover in accounting roles.

- A Strong Sense of Belonging and Purpose: When leadership communicates the firm’s goals clearly and team members understand how their work contributes to those goals, it creates a stronger connection to the firm. Employees feel like they’re part of something meaningful, not just completing tasks, but helping clients and growing a business.

Enhanced Efficiency and Productivity

Effective team management doesn’t just make your firm a better place to work, it makes it run better. With clear systems, defined roles, and aligned goals, your team can get more done in less time, without compromising on quality. For accounting firms, where deadlines and compliance are non-negotiable, productivity is a competitive advantage.

Let’s break down how this plays out in practical terms:

Maintaining Consistency in Quality

Strong management ensures that everyone follows the same processes and standards. Whether it’s monthly bookkeeping, payroll runs, or year-end accounts, a well-managed team uses checklists, review systems, and templates that reduce variation. This keeps errors low, turnaround times predictable, and client satisfaction high, essential for long-term retention and referrals.

Ensuring Alignment with Firm Goals

A team that understands and works toward the same objectives is far more effective than one operating in silos. Strong team management keeps everyone aligned with the firm’s key priorities, such as expanding advisory services, improving turnaround times, or increasing profitability. This alignment ensures that time and effort are invested where they matter most.

Addressing Increased Complexity in Operations

As firms grow, managing client deadlines, staff availability, and cross-team dependencies becomes more complex. Without structured workflows and visibility across operations, it’s easy for things to slip through the cracks. Effective team management introduces project tracking tools, process maps, and coordination systems that reduce friction and allow the firm to scale without chaos.

The benefits of managing your team well aren’t just internal, they reflect directly in your client experience, service quality, and ability to grow. Strong team management is not a soft skill but a business discipline. And in accounting, where people and processes define your output, mastering it gives you a clear competitive edge.

Step-by-Step Guide to Managing a Growing Team

Without clear roles, streamlined systems, and an effective leadership approach, teams often become inefficient, communication breaks down, and the firm struggles to deliver consistent client service.

Recent research showed that accounting firms see improved collaboration and reduced operational silos when tasks and responsibilities are clearly defined and visible [7].

This chapter outlines a practical, step-by-step approach to managing team growth in a way that keeps your firm productive, your people engaged, and your business on track. Each step is designed to help you align your team’s output with the firm’s long-term goals while building an efficient and accountable workplace.

Step 1: Establish Clear Roles and Responsibilities

Define roles and expectations for each team member

Start by identifying the core functions your team needs to fulfil: bookkeeping, tax prep, payroll, client communication, reporting, compliance reviews, etc. Each team member should know exactly what part of the process they are responsible for, and how their role fits into the wider service delivery. This eliminates confusion, reduces duplication, and helps with accountability.

Create a structured hierarchy or reporting system

As your team expands, you need more layers of reporting. A clear chain of command ensures that work flows smoothly and problems get escalated appropriately. Whether it’s a manager reviewing junior accountants’ work or a team lead handling client queries, structure helps streamline reviews and reduces dependency on the business owner for day-to-day issues.

Regularly review and update job descriptions as the team evolves

Roles change as your service offering, client base, and internal capabilities grow. Keep job descriptions aligned with current needs so that each person’s responsibilities stay relevant. This also helps during appraisals and hiring, ensuring each team member is being measured and supported accurately.

Step 2: Foster a Positive Team Culture

Encourage open communication and collaboration

In accounting, where multiple team members work on the same client file across different stages, open communication is critical. Encourage teams to ask questions, share updates, and raise issues early. This reduces errors and prevents last-minute fire-fighting during reporting deadlines.

Promote inclusivity and diversity within the team

Welcoming team members from different backgrounds and perspectives can strengthen your problem-solving and client service capabilities. Especially in offshore teams or global setups, promoting inclusivity ensures smoother collaboration, respect, and better performance.

Recognize and celebrate achievements, both individual and collective

Whether it’s recognising a junior for consistent accuracy or celebrating the team for achieving turnaround time targets, regular acknowledgment builds morale. This contributes to higher retention and motivates staff to maintain high standards.

Step 3: Streamline Communication

Implement effective communication tools (e.g., Slack, Microsoft Teams)

Choose a communication platform that allows real-time conversations, file sharing, and integration with your accounting software stack. This reduces dependency on emails and helps keep everyone updated, especially when teams are remote or hybrid.

Schedule regular team meetings to discuss goals and updates

Hold weekly or bi-weekly team huddles to review workloads, upcoming deadlines, and blockers. For accounting firms, these meetings are important for deadline planning, especially around tax seasons or reporting dates.

Foster an environment where feedback flows both ways

Encourage staff to share feedback not just on their peers but also on processes, systems, and management. This helps identify inefficiencies early and creates a culture of continuous improvement.

Step 4: Invest in Training and Development

Provide ongoing technical training on new tools and regulations

Tax laws, compliance standards, and accounting tools change frequently. Ensure your team is up to date with periodic training sessions, whether it’s mastering new cloud software or understanding revised HMRC guidelines.

Offer soft skills training (e.g., leadership, communication, time management)

Strong client communication and internal collaboration are essential, especially when team members handle queries or lead meetings. Soft skills training builds confidence and enhances your firm’s service quality.

Develop clear career growth paths for team members

Define what it takes to move from junior accountant to senior, from reviewer to manager. This motivates employees and helps with retention by showing them a long-term future within the firm.

Step 5: Delegate Effectively

Assign tasks based on individual strengths and areas for development

Assess each team member’s strengths, some might be great with clients, others with technical reviews. Matching roles with strengths improves quality, while also giving staff development opportunities by rotating assignments strategically.

Trust team members to take ownership of their responsibilities

Once tasks are assigned, step back and allow the team to manage the work. Micromanagement can damage confidence and slow down workflows. Trust allows people to grow and become more accountable.

Avoid micromanagement while maintaining accountability

Use review systems, checklists, and KPIs to ensure work is on track without checking every move. This balance builds a productive environment where people take initiative but know they are supported.

Step 6: Implement Efficient Processes and Technology

Standardize workflows and processes for consistency

Use SOPs (Standard Operating Procedures) for recurring tasks like bookkeeping reviews, VAT returns, and client onboarding. Standardisation minimises errors and ensures clients receive the same level of service from all team members.

Leverage project management tools for tracking progress

Tools like Karbon, ClickUp, or Trello can help track client files, monitor deadlines, and assign accountability. This visibility is essential for a growing team where multiple people work on interconnected tasks.

Automate repetitive tasks to free up time for value-added work

Automate bank reconciliations, invoicing reminders, and report generation where possible. This allows your team to focus on advisory tasks, client relationships, and high-level reviews that generate more value.

Step 7: Monitor Performance and Provide Feedback

Use KPIs and metrics to measure individual and team performance

Track metrics like turnaround time, review quality, and client satisfaction scores. This helps identify strong performers, spot areas for improvement, and ensure resources are allocated efficiently.

Conduct regular performance reviews and one-on-one check-ins

Formal reviews every six months, combined with informal monthly check-ins, give team members clarity on how they’re doing. This structure promotes growth and prevents underperformance from going unnoticed.

Provide constructive feedback and actionable improvement plans

Feedback should be specific, solution-oriented, and aligned with expectations. For example, if errors are found in reconciliations, outline the standard process and support the team member with extra training if needed.

Step 8: Address Conflict and Challenges Promptly

Establish a clear process for conflict resolution

Whether it’s between team members or between staff and management, having a documented process helps resolve issues calmly and fairly. In an accounting firm, unresolved conflicts can impact collaboration and client delivery.

Address team dynamics issues before they escalate

Watch out for signs of disengagement, miscommunication, or friction during team meetings and address them early. Ignoring tensions often leads to higher turnover or poor client service.

Use conflicts as opportunities for growth and learning

Encourage your team to view disagreements as chances to strengthen communication and align better. Debrief after issues are resolved and update processes if needed to prevent recurrence.

Step 9: Scale Leadership Alongside Team Growth

Identify potential leaders within your team and nurture them

As your firm grows, you need more team leads and managers. Spot people who take initiative, communicate well, and deliver consistently. Support them with coaching and development plans.

Delegate leadership responsibilities as the team expands

Let team leads take over certain areas, like managing junior staff or owning parts of the workflow. This distributes responsibility and frees up senior leadership for strategy and client relationships.

Continuously refine your leadership style to adapt to a larger team

As your team size increases, shift from day-to-day task management to strategic oversight. Invest in leadership training for yourself to better support a larger, more diverse team.

Managing a growing accounting team requires intentional planning, consistent execution, and adaptable leadership. By following this step-by-step framework, your firm can maintain high standards, build a cohesive team culture, and continue scaling without losing efficiency or control.

Conclusion

Effective team management is not just about people, it’s about building a structure that supports your accounting firm’s growth, output, and long-term success. As your team expands, having a clear, adaptable approach to managing roles, systems, communication, and leadership becomes essential.

This final chapter brings together the key principles we’ve covered, highlights the importance of proactive leadership, and encourages you to begin applying these practices within your own firm.

In Summary:

Managing a growing team in an accountancy firm requires more than just hiring more staff. The foundation lies in building processes and structures that allow the firm to scale without compromising on quality, efficiency, or staff satisfaction. Let’s recap the main principles discussed in this module:

- Clearly defined roles and responsibilities ensure that every team member knows what they’re accountable for. This reduces confusion, supports delegation, and helps maintain service standards as the team grows.

- A structured communication system, including the right tools and regular check-ins, improves collaboration and reduces delays. This is especially important in multi-location or remote accounting teams.

- Strong team culture and morale contribute directly to employee retention, productivity, and the firm’s reputation. A positive workplace is more likely to attract and keep top talent.

- Ongoing training and development ensure your team keeps pace with changing regulations, technologies, and client needs. This keeps your firm competitive and your staff skilled.

- Efficient processes and technology create consistency in how work is delivered. Standardised workflows and automation reduce manual errors and improve turnaround times.

- Leadership that grows with the team is key. As your firm expands, your leadership approach must evolve, from hands-on management to strategic oversight, supported by empowered team leads.

Each of these pillars supports the long-term sustainability and operational excellence of your accounting practice.

Emphasis on Adaptability and Proactive Leadership

No matter how well-designed your current systems are, your firm will inevitably face new challenges as it grows. A rigid management style won’t serve you well in a dynamic business environment. Instead, focus on adaptability.

Proactive leadership means regularly reviewing team performance, spotting emerging issues before they grow, and making course corrections early. It also involves staying updated on industry trends, like regulatory changes, client expectations, or shifts in technology, and preparing your team accordingly.

In the context of an accounting firm, this could mean:

- Redesigning team structures during busy tax seasons

- Adapting workflows for new software or regulatory requirements

- Revising KPIs as service lines expand or shift

- Upskilling team members for advisory roles as compliance becomes more automated

Proactive leadership is not about reacting to problems after they occur, it’s about anticipating challenges and putting systems in place before they impact performance.

Download the Workbook

Effective team management is critical for scaling an accounting firm sustainably. As your team grows, so do the complexities around communication, role clarity, leadership, and culture. This module equips you with practical strategies to navigate these challenges and create a high-performing, cohesive team.

To support you further, download the “Managing a Growing Team Workbook.” This will help you plan for and implement the steps discussed in this module and streamline your team operations with confidence.

Download the Managing a Growing Team Workbook

Bibliography

- https://www.cpajournal.com/2024/02/12/the-conflict-surrounding-work-life-balance-in-public-accounting-firms/

- https://www.abacademies.org/articles/the-effect-of-teamwork-on-employee-productivity-11961.html

- https://www.cpajournal.com/2020/01/16/employee-retention-the-state-of-engagement-in-public-accounting-firms-and-why-it-matters

- https://www.sage.com/en-us/news/press-releases/2018/03/accountants-adoption-of-ai-expected-to-increase/

- https://www.gsb.stanford.edu/insights/how-much-does-management-matter-productivity

- https://www.cfoselections.com/perspective/accounting-turnover-why-is-it-happening-and-how-do-we-stop-it

- https://www.irisglobal.com/wp-content/uploads/2023/11/Collaboration-and-Communication-Fostering-Teamwork-in-Accounting-Firms-ebook.pdf

About the Author

Rajat Kumar

Rajat is a finance and marketing professional with years of proven experience working in finance and investment KPOs.

Working with Samera’s business development experts, he specialises in creating tips, reports and articles helping accountants understand the global landscape, strategise and grow their business.

Reviewed By:

Arun Mehra

Samera CEO

Arun, CEO of Samera, is an experienced accountant and dental practice owner. He specialises in accountancy, financial directorship, squat practices and practice management.