Implementing AI for Accountants

In this module we take a look at how accountants can implement AI in their firms strategically to improve operations.

- The Dawn of AI in Accounting

- Understanding AI in the Context of Accounting Firms

- Problems AI Solves for Accounting Firms

- The Future of AI in Accounting: Trends & Transformation

- Challenges of AI Implementation in Accounting Firms

- Step-by-Step Guide to Implementing AI in Your Firm

- Key Considerations for Long-Term Success

- Conclusion: Embracing the Intelligent Accounting Future

- Download The Workbook

- Bibliography

The accounting industry is undergoing a quiet revolution. As client expectations evolve and margins get tighter, firms that once thrived on traditional bookkeeping and compliance work are now being forced to rethink how they deliver value. At the heart of this shift lies Artificial Intelligence (AI), not just as a buzzword but as a tangible lever for transforming every aspect of how accounting firms operate.

AI is no longer reserved for big tech or Silicon Valley ventures. The AI in the accounting industry is projected to grow from $4.74 billion in 2024 to $6.98 billion in 2025, at a 47.3% annual growth rate [1], signaling deeper penetration into mid- and small-scaled firms.

It’s already reshaping how firms handle routine tasks, generate insights, and deliver advisory services. Those who adopt it early will position themselves ahead of the curve. Those who don’t risk becoming irrelevant.

This module explores how AI is impacting accounting firms – practically and strategically. It sets the stage for understanding how firms can harness AI to save time, reduce errors, enhance client engagement, and ultimately grow with fewer overheads.

Key Takeaways

- AI Goes Beyond Automation: AI doesn’t just speed up tasks – it unlocks insights, enhances client service, and supports smarter decisions.

- Start with Specific Pain Points: Successful AI adoption begins by targeting inefficiencies like manual data entry, delayed reporting, or poor client segmentation.

- Efficiency is Just the Beginning: AI enables new capabilities such as predictive analytics, real-time dashboards, and automated client engagement.

- Accountants Must Evolve with AI: The role of accountants is shifting toward interpretation, advisory, and oversight of AI-generated insights.

- AI is a Firm-Wide Opportunity: Every department – accounting, admin, marketing – can benefit from AI; it must be implemented across the whole firm.

- Data is the Foundation: Clean, structured, and accessible data is essential for AI tools to generate accurate and useful outputs.

- The Time to Start is Now: Early adopters are already gaining competitive advantages – firms should start small, pilot effectively, and scale with confidence.

The Dawn of AI in Accounting

The Evolving Landscape of Accounting

Historically, accounting has been built around compliance, transaction recording, and financial reporting. Firms would focus on delivering accurate year-end accounts, payroll processing, and tax filings. The workflow was manual, linear, and labour-intensive. Value was defined by hours billed and output delivered.

But that model is under strain.

Fast forward to now, 57% of finance leaders see AI ROI exceeding expectations, compared to 29% of mainstream users [2].

The demand for real-time data, tighter turnaround times, and higher-value insights has changed the game. Clients today expect more than accuracy – they want guidance. And with rising salary costs, compliance automation, and increased competition, firms can no longer afford to run on outdated systems or processes.

Efficiency, scalability, and insight have become the new benchmarks. This is where AI steps in.

Why AI is No Longer Optional

KPMG’s AI in Finance report reveals nearly two-thirds of companies are currently piloting or using AI specifically in accounting and financial planning [3].

AI is not just another tool – it’s a foundation for the future accounting firm. What began as machine learning and automation has now evolved into intelligent systems that can process volumes of data, learn from patterns, and assist in decision-making at scale.

Here’s how AI is impacting accounting firms across the board:

- Automating Repetitive Tasks: From transaction categorisation to invoice processing, AI tools can handle routine tasks faster and more accurately, freeing up staff for higher-value work.

- Improving Client Insights: AI algorithms can analyse client financials to surface trends, anomalies, and opportunities – enabling firms to deliver proactive advisory services.

- Optimising Internal Workflows: AI-driven tools can streamline document management, task allocation, and compliance tracking – making operations leaner and more responsive.

- Enhancing Forecasting and Decision-Making: Predictive models powered by AI help firms and clients forecast cash flow, model scenarios, and plan with greater confidence.

- Reducing Human Error and Risk: AI systems are not prone to fatigue or oversight. They offer a layer of quality control that reduces compliance risks and improves accuracy.

This is not about replacing accountants – it’s about enabling firms to do more with less, and to deliver more value to clients.

What This Guide Covers

This section is the first step in helping your firm navigate the world of AI.

Over the course of this module, we’ll break down how AI can be applied across three critical areas of your accounting business:

- Core Accounting Functions: How AI tools can support bookkeeping, accounts preparation, tax computations, and compliance automation.

- Marketing and Client Engagement: How firms can use AI to improve lead generation, personalise outreach, and automate client communication.

- Administrative and Operational Processes: How AI can streamline onboarding, manage internal tasks, and support team collaboration.

The goal is not to sell AI but to help you understand where it fits, how to adopt it strategically, and how to make it work for your firm’s growth without increasing headcount or complexity.

By the end of this module, you’ll have a clear, practical roadmap to make AI a driver of efficiency, scalability, and long-term value in your accounting practice.

Understanding AI in the Context of Accounting Firms

To make strategic use of Artificial Intelligence (AI) in your firm, you first need to understand what it actually means. AI is not one tool or software, but a category of technologies that can process data, learn from patterns, and help humans make better, faster decisions.

For accounting firms, AI presents an opportunity to move beyond traditional, manual tasks and reimagine operations – from core service delivery to internal administration and marketing. This section provides a clear explanation of the types of AI relevant to accounting and how firms are already using these tools to streamline their workflows.

What is Artificial Intelligence (AI) for Professional Services?

Artificial Intelligence, in simple terms, refers to systems and software that can mimic human intelligence to analyse data, identify patterns, and make or suggest decisions.

In the context of accounting firms, AI supports three broad functions:

- Data processing at scale

- Decision support based on patterns and predictions

- Automation of repetitive or manual tasks

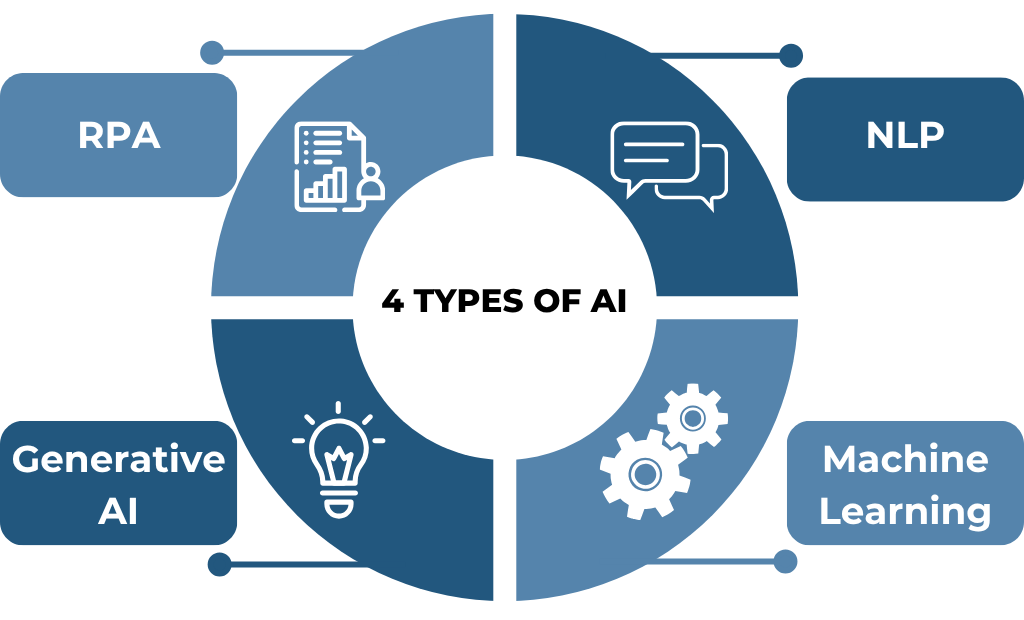

Here are four key AI concepts that accounting professionals should understand:

| AI | Description | Example |

|---|---|---|

| Machine Learning | Learns from data patterns | Predict cash flow, spot anomalies |

| NLP | Understands language | Draft client emails, summarise documents |

| RPA | Automates rule-based tasks | Data migration, report generation |

| Generative AI | Creates content based on prompts | Write newsletters, generate insights |

Machine Learning (ML)

Machine Learning allows software to learn from data without being explicitly programmed. In accounting, ML can:

- Detect anomalies in transactions

- Predict cash flow or tax liabilities

- Identify spending patterns or errors

- Categorise financial data based on past trends

Natural Language Processing (NLP)

NLP enables machines to understand and work with human language. For accounting firms, NLP can:

- Analyse contracts or financial documents

- Summarise meeting transcripts or reports

- Draft emails, newsletters, or follow-ups

- Extract key details from unstructured data like PDFs

Robotic Process Automation (RPA)

RPA refers to bots or scripts that follow rule-based instructions to complete repetitive tasks. While not always intelligent, RPA is often used in tandem with AI. In firms, RPA is useful for:

- Transferring data between systems

- Updating ledgers or CRMs

- Generating routine compliance reports

Generative AI (GenAI)

GenAI refers to AI systems that can create new content – text, summaries, images, and more – based on prompts. TR’s 2024 Generative AI in Professional Services reports 32% of all accountancy firm respondents said they were still considering whether or not to use GenAI at work [4].

For accountants, GenAI can:

- Draft marketing content or client comms

- Summarise large reports or meeting notes

- Generate advisory memos based on financial trends

Each of these technologies plays a different role, but together, they help firms become faster, more consistent, and better at delivering high-value insights.

How AI is Currently Being Used by Accounting Firms (Beyond Core Accounting)

While the most obvious use of AI is in core accounting functions, firms are now integrating AI across multiple areas – finance, operations, marketing, and admin.

According to the Journal of Accountancy, 58% of organizations use finance AI in 2024, up from 37% last year [5].

Below is a breakdown of key use cases and how they contribute to a more streamlined accounting business.

Core Accounting Applications

- Automated Data Entry & Reconciliation: 41% of accountancy firms automate workflows with AI (+4% YoY) [6]. AI tools extract data from invoices, receipts, and bank statements, matching them to accounting entries without human input. This reduces time spent on manual bookkeeping and minimises errors.

- Expense Management: AI-based expense systems automatically categorise spending, flag policy violations, and generate summaries for approvals. This saves internal effort and improves cost tracking.

- Fraud Detection & Anomaly Identification: AI systems monitor large volumes of transactions and flag unusual patterns – improving oversight, reducing risk, and making audits more focused.

- Financial Reporting & Analysis: AI can generate standard reports and provide analytical insights into revenue, margins, and cost drivers, helping partners and clients make faster decisions.

- Tax Compliance & Preparation: AI-powered platforms can automate the extraction of tax-relevant data, interpret current tax codes, and prepare draft returns – saving time and improving accuracy.

- Audit Support: AI assists in audit sampling, reviews transactions against control rules, and flags outliers. This enhances audit quality and cuts down the time needed for fieldwork.

Marketing & Client Engagement

- Content Generation: Generative AI can help marketing teams or partners quickly draft blog posts, newsletters, or social media content – based on specific services or client pain points.

- SEO Optimisation: AI-driven ad targeting helps reduce ad budget waste by nearly 30% [7]. AI tools can identify relevant search terms, analyse keyword gaps, and recommend content strategies to improve your firm’s visibility online.

- Personalised Outreach: Using AI for segmentation and behaviour analysis, firms can tailor messages based on client history or interests – improving engagement and conversion rates.

- Predictive Marketing: By analysing past interactions and market data, AI can forecast which clients are likely to need a new service – enabling timely, targeted outreach.

Day-to-Day Administration

- Email Management: AI tools can categorise emails, auto-draft replies, and summarise conversations – freeing up partner and staff time.

- Calendar Management & Scheduling: Smart assistants can propose meeting slots based on calendar availability, send invites, and manage follow-ups – without the need for manual coordination.

- Meeting Transcription & Summarisation: AI transcription tools can record meetings, extract key takeaways, and generate task lists – keeping everyone aligned without extra admin work.

- Document Management & Organisation: AI can classify internal documents, tag them for search, and auto-organise files – making firm knowledge easier to access and retrieve.

- Data Management: AI can help cleanse databases, merge duplicate client records, and keep internal systems up to date – improving the quality of firm-wide data.

- IT Support: AI chatbots and helpdesk tools can resolve basic tech queries from staff – reducing reliance on IT personnel for routine support.

Each of these applications addresses an underlying business challenge – time constraints, rising costs, or inefficient workflows.

Adopting AI in a structured, phased manner can enable accounting firms to evolve into more resilient, insight-led, and scalable businesses without adding layers of complexity.

Problems AI Solves for Accounting Firms

AI is not just about adopting a trend – it’s about solving specific business problems that accounting firms face daily. Whether you’re struggling with manual work, rising costs, staff burnout, or growing client expectations, AI provides practical tools to address these issues at scale.

This section explores the operational and strategic problems AI can help solve, enabling firms to become more efficient, accurate, and client-centric.

Boosting Efficiency & Productivity (Across the Firm)

Karbon’s The State of AI in Accounting Report 2025 reveals 85% of accounting professionals are excited about the increased speed and efficiency that AI offers [8].

Accounting firms spend a significant portion of time on administrative and low-value tasks – data entry, email sorting, calendar coordination, document formatting, etc. These aren’t core to client value but are essential for operations. Over time, this leads to excessive time costs, stretched resources, and slower turnaround.

AI addresses this by automating routine work at multiple levels:

- Data Entry & Reconciliation: AI-powered bookkeeping tools extract information from receipts, bank statements, and invoices and auto-enter them into accounting software. This eliminates hours of manual input and checking.

- Calendar & Meeting Scheduling: AI assistants like x.ai or Microsoft Copilot can schedule meetings based on availability, send reminders, and even coordinate across time zones without manual input.

- Document Drafting & Formatting: AI can auto-draft proposals, engagement letters, and routine client communication by pulling in data from your systems – reducing admin time for partners and senior staff.

Over time, these automations compound to increase firm-wide output without increasing headcount, allowing more time to be spent on billable or high-impact work.

Enhancing Accuracy & Reducing Errors

Even experienced accountants are vulnerable to errors when juggling large datasets or tight deadlines. Simple copy-paste mistakes, version control issues, or misclassified transactions can lead to compliance risks, rework, or client dissatisfaction.

AI-driven systems enhance accuracy in two key ways:

- Rule-Based Validation: AI tools can apply consistent validation rules across thousands of entries. For instance, invoice dates that don’t match payment timelines, duplicate entries, or inconsistent VAT codes are flagged in real time.

- Self-Learning Improvements: Over time, AI learns patterns in your firm’s historical data – improving how it classifies, categorises, or flags exceptions. This reduces error rates even further as the system matures.

For firms handling multi-entity reporting, global clients, or multi-currency transactions, the risk of error is higher – and AI helps bring it under control with better process consistency.

Providing Deeper Insights & Predictive Analytics

KMPG’s AI in Financial Reporting and Audit report states that 55% of leaders in the finance and accounting space currently use AI and machine learning significantly improve data analysis capabilities [9].

Traditional financial analysis often looks backward – reporting what happened. But clients today want forward-looking insight: Where are we heading? What should we be planning for?

AI enables proactive advisory through:

- Cash Flow Forecasting: AI tools can model future cash flow based on past inflows, recurring expenses, seasonal patterns, and even macroeconomic indicators. This helps both firm management and client advisory.

- Client Behaviour Insights: AI can track how often a client delays payments, misses deadlines, or queries bills. This helps firms anticipate issues and shape how they engage with each client.

- Service Pattern Trends: For firms offering bundled services (bookkeeping, payroll, tax), AI can analyse uptake patterns and suggest when to cross-sell or adjust pricing.

These predictive tools allow firms to shift from being reactive service providers to proactive business partners – one of the key differentiators in a competitive market.

Improving Marketing & Client Engagement

Marketing has long been a challenge for accounting firms. Campaigns often feel generic, lack targeting, and fail to convert. Worse, partners may be too busy to contribute consistent messaging.

AI modernises marketing in several ways:

- Content Creation: Tools like Jasper or ChatGPT can generate tailored blogs, client emails, or LinkedIn posts with firm-specific prompts. They reduce the time burden while maintaining relevance.

- Client Segmentation: AI can cluster clients based on service usage, firmographics, or engagement history. This allows firms to run focused campaigns – e.g., a newsletter about R&D tax relief only to clients in eligible industries.

- Campaign Optimisation: AI-powered analytics platforms help identify what messaging performs well, what time clients open emails, or what services they click on – feeding future strategy.

- Predictive Engagement: If a client historically engages with year-end planning advice in Q3, AI can trigger a timely message offering a review session before deadlines approach.

This targeted approach increases the ROI of marketing spend and helps firms stay visible to their client base throughout the year – not just during compliance deadlines.

Enhancing Compliance & Risk Management

Regulatory compliance is always a moving target for accountancy firms. When it comes to AI, 12% of accounting and finance leaders are prioritising Regtech, or regulatory technology, as an AI-enabled solution come the next year [10].

From frequent tax rule changes to GDPR obligations and AML checks, the stakes are high and manual tracking is unreliable.

AI supports compliance in practical, ongoing ways:

- Legislative Monitoring: Some AI tools now automatically update internal compliance rules when legislation changes – removing the need for constant manual monitoring.

- Automated Document Checks: AI can review uploaded financial documents or filings to ensure required formats, fields, and declarations are present and correct.

- AML Screening & Risk Flags: AI-based onboarding tools can scan new clients against global watchlists, monitor unusual activity, and flag potential red flags automatically.

- Audit Trail Generation: AI systems log every change, comment, or edit made in a workflow, which simplifies audit preparedness and ensures accountability.

By embedding compliance into operational systems, firms can reduce their exposure to financial and reputational risk without creating bottlenecks.

Enhancing Client Service & Advisory Capacity

Firms that want to move up the value chain must shift from task execution to insight delivery. But this is often limited by time, data quality, or gaps in analysis.

AI helps by enabling advisory at scale:

- Real-Time Dashboards: Clients can access up-to-date views of their business health without waiting for month-end reports. This supports continuous engagement and decision-making.

- Automated Insights: Some platforms now offer “insight suggestions” – highlighting if profit margins are slipping, payroll is trending upward, or debtor days are rising – based on the client’s own data.

- AI-Powered Client Support: Chatbots trained on firm-specific data can handle routine client queries – file access, deadline reminders, document formats – freeing up your staff to focus on deeper issues.

- Pre-Advisory Prep: Before a meeting, AI can prepare briefs with financial snapshots, client history, and trend charts – so partners are better informed and clients feel heard.

This shift allows firms to build stronger client relationships and command premium pricing for strategic input – not just compliance output.

Cost Savings & Scalability

One of the biggest constraints on growth for accounting firms is that more clients typically mean more staff, more overhead, and more manual oversight. This model hits the ceiling fast.

AI breaks this cycle by unlocking:

- Operational Cost Reduction: Automating tasks like data reconciliation, reporting, and communications reduces the need for additional staff as the firm scales.

- Improved Capacity: Firms can take on more clients or more complex accounts without burning out existing teams.

- Process Standardisation: AI helps create consistent workflows, which means faster onboarding of staff or offshore teams and reduced training costs.

- Better Use of Human Capital: Staff can be reskilled into client-facing or analytical roles instead of being stuck in repetitive tasks – improving retention and morale.

The long-term outcome is a business model that grows in revenue without growing proportionally in costs – a major advantage in a low-margin service environment.

AI doesn’t just improve how accounting firms work—it fundamentally changes what’s possible. From reducing operational friction to unlocking new service models, it allows firms to do more with less, offer more strategic value, and future-proof their operations in a fast-changing industry.

The Future of AI in Accounting: Trends & Transformation

AI is already changing the way accounting firms operate, but we are only at the beginning. In the years ahead, AI will no longer be just an automation tool – it will become a foundational layer across every part of a firm’s operations. From client service and compliance to internal collaboration and marketing, the accounting profession is headed for a deep transformation.

This section looks ahead at the trends shaping that future and what firms must understand to remain competitive and relevant.

AI as a Strategic Partner

Until recently, AI in accounting was viewed primarily as a tool for automating low-value or repetitive tasks – invoice data capture, reconciliations, report generation. But its role is expanding quickly.

Firms are now starting to use AI as a strategic co-pilot – a system that not only helps execute tasks but also analyses outcomes, identifies improvement areas, and supports decision-making.

In practice, this looks like:

- AI-powered dashboards recommending when to switch a client to quarterly tax planning based on cash flow patterns.

- AI engines benchmarking firm performance against industry data to inform pricing or resource allocation.

- Strategic “nudges” sent to partners based on trends – e.g., rising work-in-progress levels, fee overruns, or at-risk clients.

This means AI will increasingly sit at the centre of firm strategy – not just operations. It will inform business decisions, not just automate them.

Hyper-automation & Intelligent Workflows

The next phase of AI adoption will involve hyper-automation – using AI to automate not just individual tasks, but entire interconnected workflows that span across functions and departments.

For accounting firms, this means:

- Tax Planning and Optimisation: AI platforms that analyse client data, suggest tax-saving strategies, and even pre-fill return drafts based on current laws.

- Compliance Monitoring: Continuous AI-based surveillance for audit risks, AML violations, or non-compliant transactions – flagged automatically for partner review.

- Marketing Automation Funnels: Tools that segment clients, generate content, trigger campaigns based on behaviour, and report on engagement without human input.

These intelligent systems can make decisions within boundaries, escalate issues when needed, and adapt based on firm feedback. The end result: smoother client journeys, faster delivery cycles, and better oversight.

Generative AI’s Growing Role

Generative AI (GenAI) is advancing rapidly in capability and relevance. In accounting, its value lies not just in content creation – but in how it helps transform raw data into clear, useful narratives.

Its growing roles include:

- Drafting financial summaries: GenAI tools can explain key movements in a P&L or balance sheet in plain language – suitable for clients without financial expertise.

- Creating legal disclaimers or custom terms: Tailored to each engagement and based on firm templates, with review loops built in.

- Writing bespoke client reports: Pulling in accounting data, industry benchmarks, and operational trends, and presenting it in a polished, client-ready format.

- Marketing material generation: From landing pages and newsletters to SEO-optimised blogs, tailored to client segments and firm goals.

Over time, these tools will become more reliable, more integrated, and more central to how firms communicate – both internally and externally.

Evolving Skillsets for Accountants & Support Staff

As AI takes over the more mechanical parts of accounting work, the nature of human roles within firms is changing.

Accountants and support staff will need to grow skills in:

- Data interpretation: Understanding what AI-generated outputs mean for clients and turning them into action.

- Critical thinking: Making judgment calls where AI cannot (yet) account for nuance, ethics, or complex context.

- Client relationship management: Spending more time advising, educating, and listening to clients.

- AI prompt engineering: Learning how to get the best out of AI tools by crafting effective prompts or input structures.

- Ethical oversight: Ensuring outputs are compliant, fair, and aligned with both professional standards and client interests.

This shift requires a mindset of continuous learning, as well as new internal processes for training and upskilling staff across all levels.

Integration with Other Technologies

AI will not evolve in isolation. Its impact will multiply when combined with other emerging technologies already entering the accounting landscape.

Key integrations to watch:

- Cloud Accounting Platforms: AI tools embedded within platforms like Xero, QuickBooks, or Sage will offer smarter suggestions, real-time alerts, and advanced analytics without requiring external add-ons.

- CRM & Practice Management Systems: AI will help streamline onboarding, follow-ups, renewals, and reviews by analysing client interactions and internal workflows.

- Blockchain: Combining AI with blockchain could offer enhanced audit trails, smart contract execution, and fraud detection with greater reliability and traceability.

- Client Portals: AI-integrated portals can offer clients self-serve options, automated Q&A, and intelligent dashboards – all while giving the firm better visibility of client activity and needs.

The accounting firm of the future will operate within a connected, intelligent ecosystem with AI acting as the glue across platforms and workflows.

The future of AI in accounting is not about replacement – it’s about augmentation. Firms that embrace this shift now will not only gain operational advantages, but also redefine how they deliver value to clients.

From deeper insights and faster delivery to enhanced advisory and greater scalability, AI is becoming the central nervous system of modern accountancy. The firms that thrive will be the ones that treat AI not as an IT initiative, but as a firm-wide strategic priority.

Challenges of AI Implementation in Accounting Firms

For all its transformative potential, AI in accounting is not a plug-and-play solution. The journey from concept to real-world application comes with substantial friction, including technical, operational, and cultural aspects. Whether you’re a small accounting practice or a multi-office firm, navigating these obstacles is critical to avoid sunk costs, half-baked integrations, or staff pushback.

This section explores the key barriers that firms must navigate to embed AI meaningfully across their operations.

Data Quality & Availability

The performance of any AI system depends heavily on the quality of the data it processes. Inaccurate, incomplete, or poorly structured data leads to flawed outputs, no matter how advanced the technology.

For accounting firms, this challenge takes several forms:

- Inconsistent data entry across bookkeeping records, spreadsheets, or CRMs can distort financial outputs and analytics.

- Data silos between departments – such as finance, tax, and marketing – limit the potential for AI to find patterns or generate firm-wide insights.

- Legacy formats or disconnected tools often prevent smooth data flow into AI systems, reducing their usefulness.

AI tools require structured, standardised, and up-to-date data sets to work effectively. Whether it’s client financial history, email communications, or compliance logs. Firms that lack robust data hygiene and integration practices will find AI implementation limited or misleading.

High Initial Costs & ROI Justification

Implementing AI across a firm is not just a plug-and-play affair. It involves investment across several layers:

- Software subscriptions or custom AI models tailored to accounting tasks.

- Cloud infrastructure or APIs to integrate data sources and workflows.

- Staff training on AI tools, prompt engineering, and new processes.

This can create hesitation, especially for small to mid-sized firms where margins are tighter. The added difficulty lies in quantifying ROI early on, particularly for non-billable functions like admin automation, email management, or marketing content generation.

Yet, without measuring clear returns (e.g., time saved per process, reduced rework, increased client engagement), firms may struggle to justify further investment. A phased approach to adoption with performance benchmarks can help reduce financial risk while building a case for broader rollout.

Resistance to Change & Skill Gaps

AI adoption is often less about the tool and more about the people using it. In fact, 40% accounting and finance pros cite limited AI skills and talent as a key barrier to successful integration [11].

Many team members may worry about job displacement, particularly those whose roles involve routine or transactional work. This fear can lead to resistance – even passive non-adoption – which slows down or derails implementation efforts.

Beyond fear, there is also a real skills gap:

- Accountants and admin staff may be unfamiliar with AI tools or feel overwhelmed by new interfaces.

- There’s often a lack of internal champions who can guide others in using AI effectively.

- Learning how to prompt or audit AI systems isn’t intuitive and requires hands-on exposure.

This makes internal training and cultural onboarding just as important as technical readiness. Firms that invest in upskilling and foster a mindset of augmentation are more likely to see successful adoption.

Integration with Existing Systems

Accounting firms typically operate a mix of legacy systems – ERP platforms, tax software, CRMs, project trackers – that are not always compatible with modern AI tools.

Common integration barriers include:

- Closed architectures that don’t allow API access or external data flows.

- Disjointed data formats that create inconsistencies between systems.

- Limited IT capacity to manage complex integrations or system upgrades.

For AI to deliver value across the firm, it needs to function within the existing ecosystem, or firms must upgrade those ecosystems incrementally. A patchwork of disconnected systems limits the scalability and visibility of AI’s benefits.

Data Security, Privacy & Ethical Concerns

AI tools – especially those hosted on third-party platforms – introduce serious questions around data protection and regulatory compliance.

Key concerns include:

- Client confidentiality: Financial and personal data flowing into cloud AI platforms must be secured through encryption, access controls, and vendor diligence.

- Bias and fairness: AI systems trained on flawed data may produce biased results – such as favouring certain client types or inaccurately flagging risk.

- Transparency: AI-generated outputs must be traceable and explainable, especially for audit or compliance reviews.

- Regulatory adherence: Tools must comply with frameworks like GDPR, industry-specific rules, and ethical codes of conduct (e.g., ICAEW guidelines).

As firms adopt AI, they must ensure that ethical governance keeps pace. This includes not just selecting compliant vendors but also creating internal review processes to regularly evaluate AI outputs and data flows.

AI adoption in accounting is not without obstacles. But each challenge is solvable with the right strategy. From improving data hygiene and training staff to upgrading systems and establishing strong governance, firms that approach AI implementation thoughtfully will unlock its long-term value. These challenges are not reasons to avoid AI, but prompts to do it right.

Step-by-Step Guide to Implementing AI in Your Firm

Implementing AI in an accounting firm isn’t just about buying software or automating one task. It requires a structured, phased approach – from identifying where AI can deliver value, to choosing the right tools, integrating them into existing systems, and training your team to use them effectively.

This section outlines a practical roadmap that firms can follow to begin and scale AI adoption responsibly and efficiently.

Phase 1: Strategy & Assessment (The “Why” and “What”)

Identify Pain Points & Opportunities

Start by reviewing your firm’s workflows – across accounting, admin, and marketing. Pinpoint where bottlenecks, inefficiencies, or human dependency slow things down. Examples include:

- Accounting: Time spent manually coding transactions, reconciling statements, or reviewing reports.

- Marketing: Delays in creating content or identifying leads.

- Admin: Manually scheduling meetings or sorting through client queries.

Use team feedback, time-tracking data, or error logs to determine high-impact areas. Focus on tasks that are repetitive, data-heavy, or rule-based, where AI offers immediate productivity gains.

Define Clear Goals & KPIs

For any AI implementation to be successful, define clear expectations. Your objectives should be quantifiable, such as:

- 30% reduction in time spent on monthly bank reconciliations.

- 20% increase in turnaround time for management accounts.

- 40% improvement in client email response rates.

These benchmarks help measure success and keep AI projects grounded in business outcomes.

Conduct a Data Audit

AI tools rely on quality data. Before deployment, assess your firm’s existing data:

- Financial data: Is it standardised across clients?

- CRM data: Are contact records accurate, updated, and segmented?

- Marketing data: Is campaign performance tracked and retrievable?

Address inconsistencies, remove duplicates, and ensure accessibility for AI tools. Consider centralising data sources through integrated platforms.

Build a Cross-Functional Team

AI is not an IT-only initiative. Create a team with representation from:

- Accounting staff (to define core use cases).

- Admin and operations (to identify manual inefficiencies).

- Marketing (to explore content and campaign automation).

- IT or external consultants (to manage integrations and technical fit).

This approach ensures buy-in, relevance, and faster adoption across the firm.

Phase 2: Solution Selection & Acquisition (The “How”)

Off-the-Shelf AI Solutions

These tools are ready to deploy and ideal for firms starting with AI. Common examples:

- Accounting software with AI features (e.g., Xero’s bank rule learning, QuickBooks’ transaction predictions).

- Invoice & receipt automation tools (e.g., Dext, AutoEntry).

- AI tools for marketing (e.g., Jasper for copywriting, SurferSEO for content optimisation).

- Admin tools (e.g., Fireflies for meeting transcription, Calendly for scheduling with AI assistance).

Pros: Fast setup, vendor support, low entry cost.

Cons: Limited customisation, risk of overpaying for features you may not use.

Bespoke AI Development

Larger or niche firms may need custom AI applications – for example, a tailored predictive model for client churn, or an AI assistant that learns firm-specific tax workflows.

Pros: Competitive edge, full control.

Cons: Requires external AI consultants or in-house data scientists, longer implementation timeline, higher costs.

Only consider this if you’ve exhausted off-the-shelf options or have highly unique use cases.

Hybrid Approaches

Most firms benefit from combining plug-and-play tools with some level of customisation or integration. For instance:

- Using Zapier to connect your accounting software with an AI-powered email platform.

- Embedding ChatGPT API into your internal helpdesk chatbot.

This approach offers the flexibility of tailoring without building from scratch.

Phase 3: Pilot, Integrate & Scale (The “Doing”)

Start with a Pilot Project

Don’t roll out AI across the firm at once. Begin with a contained, low-risk use case that delivers quick wins. Examples:

- Use GenAI to draft initial versions of blog posts.

- Automate categorisation of transactions for one client group.

- Deploy an AI assistant for summarising internal meeting notes.

A well-scoped pilot builds confidence and provides measurable outcomes before broader adoption.

Data Preparation & Cleansing

Before deploying AI, ensure your data is in the right format, labelled properly, and stripped of inconsistencies. In accounting, this could mean:

- Ensuring all invoices follow a standard structure.

- Resolving duplicate entries in client records.

- Filling gaps in historical marketing performance data.

Feeding poor data into AI only results in poor recommendations.

Integration with Existing Systems

AI should not sit in a silo. It must integrate with:

- Core accounting platforms (Xero, QuickBooks, Sage).

- CRM systems (HubSpot, Zoho CRM).

- Marketing tools (Mailchimp, Google Analytics).

- Admin software (Microsoft 365, Slack, Zoom).

Ensure bi-directional data flow so AI can both learn from and act within these systems.

Iterate and Refine

Post-pilot, review what worked and what didn’t. Ask:

- Did the AI produce accurate outputs?

- Was it easy for staff to use?

- Did it meet KPIs?

Use feedback to adjust models, refine workflows, or choose alternate tools before scaling.

Phased Rollout & Scaling

Gradually extend AI adoption:

- Start with accounting automation, then expand to marketing.

- Deploy across one team before a firm-wide launch.

- Scale based on results, team readiness, and budget.

Avoid all-at-once rollouts, which often create disruption and dilute ROI.

Phase 4: Training, Change Management & Oversight (The “Sustaining”)

Comprehensive Staff Training

Your team needs practical training – not just tool walkthroughs, but also:

- How to prompt AI for better outputs (especially GenAI).

- What tasks AI handles, and what needs human judgment.

- How to interpret and verify AI-generated insights.

Offer role-based training sessions so accountants, marketers, and admin staff each get relevant guidance.

Foster a Culture of Innovation

Resistance to AI often stems from fear. Leadership must:

- Communicate AI’s role as a collaborator, not a replacement.

- Celebrate small wins from AI implementation.

- Encourage teams to experiment with AI for small tasks (e.g., drafting emails, creating dashboards).

Over time, this creates an internal culture of tech-forward thinking.

Establish AI Governance & Ethics Policies

Clearly define:

- What data can be used by AI tools (especially client-sensitive information).

- When outputs must be reviewed by humans.

- Rules for transparency, such as disclosing AI-generated communications to clients.

This is especially important to remain compliant with GDPR, industry-specific financial regulations, and ethical best practices.

Continuous Monitoring & Performance Review

Track the impact of AI across:

- Time saved per task.

- Reduction in manual errors.

- Increase in lead conversions.

- Client satisfaction and service response time.

Review this data quarterly to decide whether to expand, refine, or sunset any AI initiative.

Regular Updates & Maintenance

AI is not a one-time setup. Tools evolve, APIs change, and regulations shift. Assign responsibility for:

- Monitoring vendor updates and new feature releases.

- Re-training teams when features change.

- Regularly testing outputs to maintain accuracy.

Staying current ensures that your firm benefits from the full potential of the AI tools in use.

From identifying use cases to piloting, scaling, and sustaining, you can reduce risk, maximise ROI, and align technology with firm-wide goals. The firms that thrive with AI are building capabilities, training their people, and ensuring AI fits seamlessly into the way they work. AI adoption in accounting firms should be a deliberate, strategic journey following a phased approach.

Key Considerations for Long-Term Success

Successfully implementing AI in an accounting firm is a long-term shift in how work is done, decisions are made, and value is delivered. Sustained impact from AI depends on how well a firm manages people, data, ethics, and external partnerships.

This section explores the foundational principles every accounting firm should embed to ensure their AI adoption remains secure, ethical, and effective over time.

Human-AI Collaboration

AI tools are designed to enhance and not replace human expertise. In accounting, this means that while AI can process data, spot anomalies, or draft reports, skilled professionals are still essential for:

- Interpreting results and advising clients based on broader context.

- Validating AI outputs, especially in areas like tax planning or compliance.

- Applying professional judgment in scenarios where nuance or exception handling is required.

Firms must position AI as a co-pilot, handling repetitive or data-heavy tasks, so that accountants, marketers, and administrators can focus on strategic, value-added work. This shift improves both client service and internal job satisfaction.

Encouraging teams to experiment with AI tools (like forecasting assistants or content generators) in day-to-day work builds confidence and embeds collaboration into firm culture.

Data Governance & Security

AI systems rely heavily on the quality, structure, and security of data. Without proper data governance, firms risk regulatory breaches, client trust erosion, or AI tools producing poor results.

Key practices include:

- Centralising data storage across financial, marketing, and CRM systems to avoid duplication and data silos.

- Setting strict access controls for sensitive information like tax records or client credentials.

- Encrypting data at rest and in transit, especially when using cloud-based AI applications.

- Creating a data classification policy, so staff know what data can be used for AI training and what requires manual oversight.

- Regular audits and penetration testing to detect vulnerabilities and remain compliant with data protection laws like GDPR or jurisdiction-specific financial regulations.

Data quality also needs ongoing review, dirty or incomplete data undermines AI effectiveness and can skew results.

Ethical AI Use

As firms adopt AI for decision-making and client communication, ethical oversight becomes essential. Ethical AI in accounting means:

- Transparency: Clients and staff should know when they’re interacting with AI-generated insights, emails, or reports.

- Fairness: AI tools used in recruitment, client onboarding, or credit assessments must not reinforce bias (e.g., favouring certain client types).

- Accountability: The firm must retain responsibility for decisions, even if an AI tool provided the recommendation.

Introduce internal checks, such as:

- Human review of AI-driven reports before client delivery.

- Documented processes for how AI outputs are approved.

- Ethics boards or designated oversight teams (especially in larger firms) to review new AI tools before adoption.

Firms that maintain a strong ethical stance build trust with clients and protect themselves from legal and reputational risks.

Building an AI-Ready Culture

An accounting firm’s ability to adapt to AI is as much about people and mindset as it is about technology. To build a resilient, forward-looking culture:

- Encourage continuous learning through workshops, tutorials, and tool-specific training (e.g., how to use GenAI for client communication or analyse financial trends).

- Reward experimentation, such as recognising employees who adopt AI tools to improve internal processes.

- Demystify AI – host internal sessions to explain how tools work and dispel fears of job loss or irrelevance.

- Break down departmental silos, so marketing, admin, and accounting teams collaborate on cross-functional AI applications.

Leadership plays a key role in setting the tone. When firm leaders use and advocate for AI adoption in their own workflows, the rest of the team is more likely to follow.

Partnering with AI Experts

While firms can manage many AI initiatives in-house, certain areas, especially bespoke solutions like system integration or model tuning, require specialist input. Partnering with AI consultants or niche software vendors helps:

- Avoid technical missteps during tool deployment or integration.

- Customise AI models for specific workflows, such as high-volume reconciliation or client churn prediction.

- Ensure compliance with evolving legal and technical standards in AI usage.

- Optimise performance through regular tuning and performance audits.

In the long run, this external expertise helps the firm build internal capability as well. Consultants can train internal teams and transfer knowledge during implementation.

Choose partners who understand the unique needs of accounting firms, including compliance, accuracy, and the client service environment.

Accounting firms that invest in collaboration, data security, ethical practice, cultural adaptability, and expert partnerships will be better positioned to extract long-term value from AI. These foundational elements ensure the firm remains competitive, trusted, and ready for whatever comes next in the AI landscape.

Conclusion: Embracing the Intelligent Accounting Future

Artificial Intelligence is not a passing trend anymore. It’s changing how accounting firms operate, serve clients, and grow. Whether you’re running a small boutique practice or a mid-sized multi-service firm, AI offers a path to streamline routine work, gain sharper insights, and elevate your client offering. But this journey is much more than just plugging in new tools.

This final section recaps the transformative potential of AI and offers a clear call to action for firms ready to make their next move.

7 Key Takeaways from This Lesson

Across the previous sections, we’ve seen that AI is no longer confined to automating invoices or reconciling bank statements.

Here are 7 key takeaways from the lesson to help you recap your AI in accounting learnings:

- AI Goes Beyond Automation: AI is not just for data entry or reconciliation. It enhances everything from financial analysis to strategic decision-making, client service, marketing, and internal operations.

- Start with Specific Pain Points: Successful AI adoption begins by identifying areas of inefficiency or opportunity, whether it’s reducing time spent on admin tasks or improving cash flow forecasting.

- Efficiency is Just the Beginning: AI doesn’t just make existing tasks faster; it enables new capabilities, such as predictive analytics, hyper-personalised marketing, and always-on client support.

- Accountants Must Evolve with AI: The role of accountants is shifting – from doing manual work to interpreting data, advising clients, and overseeing AI-driven processes with human judgment.

- AI is a Firm-Wide Opportunity: From partners to junior staff, marketing teams to admin support – every function stands to gain from AI. Adoption must be cross-functional and not siloed.

- Data is the Foundation: No AI system works without good data. Firms must invest in cleaning, structuring, and governing their data to get meaningful results from AI tools.

- The Time to Start is Now: Waiting for AI to ‘mature’ is no longer an option. Early adopters are already gaining competitive advantages. Start small, pilot thoughtfully, and scale with confidence.

The biggest risk for accounting firms right now isn’t adopting AI too soon – it’s waiting too long. The firms that thrive in the next five years will be the ones that:

- Start with a clear plan, identifying areas where AI can drive quick wins.

- Invest in their people, ensuring that accountants, marketers, and admins are equipped to work alongside AI tools.

- Adopt a mindset of iteration, treating AI as a process of continuous improvement – not a one-time investment.

- Establish guardrails, with sound data governance, ethical practices, and robust change management.

- Collaborate across roles, breaking down silos so every function can contribute to a smarter, more responsive firm.

If you haven’t started your AI journey, now is the time. Start small but start. Whether it’s piloting AI in marketing, automating reconciliations, or adopting an AI-powered reporting tool, each step builds capability and confidence.

Download The Workbook

Now, it’s time to put everything you’ve learned into action. In the workbook below, you’ll plan and strategise your first pilot test for implementing AI in your practice.

Download the AI Workbook

Bibliography

- https://www.thebusinessresearchcompany.com/report/artificial-intelligence-in-accounting-global-market-report

- https://kpmg.com/xx/en/media/press-releases/2024/11/ai-adoption-across-finance-functions-achieves-standout-levels-of-roi.htm

- https://assets.kpmg.com/content/dam/kpmg/co/sac/pdf/2025/04/AI%20in%20finance%20-%20TMT%20sector%20slipsheet.pdf

- https://www.thomsonreuters.com/content/dam/ewp-m/documents/thomsonreuters/en/pdf/reports/tr4322226_rgb.pdf

- https://www.journalofaccountancy.com/news/2024/sep/organizations-turning-to-ai-in-finance-function

- https://karbonhq.com/resources/state-of-ai-accounting-report-2025

- https://www.numberanalytics.com/blog/7-ai-stats-ad-targeting-success

- https://karbonhq.com/resources/state-of-ai-accounting-report-2025

- https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2024/kpmgus-ai-in-financial-reporting-and-audit-may-24.pdf

- https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2024/kpmgus-ai-in-financial-reporting-and-audit-may-24.pdf

- https://kpmg.com/kpmg-us/content/dam/kpmg/pdf/2024/kpmgus-ai-in-financial-reporting-and-audit-may-24.pdf

About the Author

Rajat Kumar

Rajat is a finance and marketing professional with years of proven experience working in finance and investment KPOs.

Working with Samera’s business development experts, he specialises in creating tips, reports and articles helping accountants understand the global landscape, strategise and grow their business.

Reviewed by

Arun Mehra

Samera Founder & CEO

Arun, founder and CEO of Samera, is an experienced accountant and dental practice owner. He specialises in accountancy, building businesses, financial directorship, squat practices and practice management.